Asian Markets

September 28, 2021

More on China Energy Programs

China’s crackdown on intensive energy use ripples across petrochemical sector

Highlights

Cracker, PDH plants mull output cuts, hikes amid impact on margins

Coal shortage further constrains operations in coal-olefin sector

Bigger producers can gain — if they manage energy costs

China’s increasingly strident efforts to curb intensive energy use and hasten carbon emission cuts are prompting petrochemical makers using LPG or naphtha as feedstock to adjust run rates in response to the various impacts the move is having across the petrochemical sector.

The crackdown comes at a time when prices of LNG, a cleaner but costlier alternative to coal as a generating fuel, are rallying ahead of winter and coal usage by households for heating is being prioritized over industrial requirements amid low stockpiles and concerns over generation capacity.

The coal shortage is constraining operations in the coal-olefin industry, while higher LNG costs for generation are impacting the economics of petrochemical plants that use other feedstocks.

China’s total electricity consumption rose 13.8% over January-August, outpacing an 11.3% increase in power generation over the same period, National Development and Reform Commission data showed.

The coal-olefin sector has cut runs to reduce intense power usage after the Yuan 126 billion ($19.6 billion) coal-olefins plant in northwest Shaanxi province was suspended for flouting energy consumption limits.

That sector is estimated to account for 20%-25% of China’s polypropylene production. The rest is estimated to come from oil — mainly naphtha cracking at steam crackers — at 55%, with LPG cracking at propane and mixed alkane dehydrogenation plants accounting for 12%-14% and methanol around 6%, according to data from domestic information provider Longzhong and industry sources.

LPG demand from the chemical and petrochemical sectors was estimated to account for more than half of China’s total LPG demand in 2020, Longzhong data showed.

Coal-fired power plants generate around 50% of China’s electricity supply.

Lower PP output

Reduced PP production from coal-olefin plants could result in higher PP margins, which could theoretically provide more market share for the LPG cracking sector, including PDH plants and boost LPG demand by 10%, a trade source with China Gas said.

However, operating rates at some PDH plants, especially those in eastern Jiangsu and southern Guangdong provinces, are also expected to be affected by local governments’ power-rationing policies, market sources said.

The NDRC has alerted 10 provinces or regions including Guangdong, Jiangsu, Yunnan, Fujian, Shaanxi, Guangxi, Ningxia, Qinghai, Xinjiang and Hubei that they have not met energy-consumption targets for the first half of 2021.

Guangdong recently imposed a new round of power rationing on industrial users, cutting their power supply for 4-5 days a week, according to a report by the province’s development and reform commission Sept. 25.

Dongguan Juzhengyuan in Guangdong shut its PDH plant for four days in September due to power rationing, reducing its operating rate to 69.75% from full capacity in August, according to domestic energy information provider JLC.

Jiangsu has also enforced power rationing on industrial users, supplying power for two days and cutting supply for two days, local media reported.

Oriental Energy has lowered the operating rate at its Zhangjiagang PDH plant in Jiangsu in September due to power rationing, market sources said.

Crunching margins were also constraining operating rates at many PDH plants. Their LPG feedstock import costs have risen significantly in recent months, while the domestic price of their propylene has lagged far behind amid weak demand from downstream plants.

Chemical and petrochemical plants are also considered energy-intensive enterprises and their operating rates have been limited or cut by some local governments, domestic media reported.

“We are still watching for more government announcements regarding the power cut issue,” an industry source said. “So far we are not expecting much impact on the PDH side, more on the coal-to-olefin side. As for crackers/PDH plants, as long as they are not under maintenance or facing technical issues, they will be running at maximum rates.”

LPG demand boost

But another trade source said power cuts by provinces and shrinking margins had prompted SP Chemical to lower operating rates at its 700,000 mt/year LPG-based cracker at Taixing in Jiangsu to 60-70% of capacity, while a company source said Jiangsu Sailboat Petrochemical was delaying the restart of its methanol-to-olefins plant.

The trade source said major petrochemical producers that were able to afford and procure alternative generating fuel such as LNG or Russian piped gas – as happened in 2018 – could boost operating rates at PDH plants or steam crackers to leverage the prospects of higher PP margins.

Soaring LNG prices have encouraged some factories, mostly ceramic makers, to switch to LPG as burning fuel from natural gas. This was expected to lift LPG demand to a limited extent, a trade source in Shanghai said.

Natural gas demand from the power generation sector was estimated to comprise 16% of China’s total gas demand in 2020, National Energy Administration data showed.

Regional LPG prices hovering near seven-year highs have prompted some ethylene producers to switch to cheaper naphtha as feedstock, though this is estimated to reduce LPG demand by less than 10%, another source said.

“The strength of naphtha is because of expensive LPG. There is more demand from petrochemical producers as they are cutting their use of butane and propane in cracking,” a Singapore-based naphtha trader said.

But one Chinese petrochemical source said trading firm Unipec was heard buying less naphtha than in previous years, and increasing imports of light crude.

September 28, 2021

Everyone is Analyzing China Lately

Goldman Cuts China’s Q3 GDP Growth To 0% As A Result Of Growing Energy Crisis

by Tyler DurdenMonday, Sep 27, 2021 – 07:04 PM

It’s not just Europe that is suffering the mother of all commodity and energy price shocks: slowly but surely a similar fate is befalling China, where a perfect storm of increased regulation, extremely tight global energy supply, the escalating trade spat with Australia, surging coal prices and a crackdown on carbon has led to energy shortages first at factories and manufacturers and more recently, mass blackouts hitting tens of millions of residents in at least three Chinese provinces (as we discussed earlier).

In our commentary to China’s growing energy problem we said that “while the blackouts starting to hit household power usage are at most an inconvenience, if one which may soon result in even more civil unrest if these are not contained, a bigger worry is that the already snarled supply chains could get even more broken, leading to even greater supply-disruption driven inflation.”

But there’s more than just supply chains: as Goldman’s China strategist Hui Shan writes in a note published late on Monday, “the recent sharp cuts to production in a range of high-energy-intensity industries add to the already significant downside pressures in the growth outlook.”

While the Goldman strategist explains more in detail further, the production cuts are due primarily to increased regulatory pressure on provinces to meet energy use targets for 2021 but also reflect surging energy prices in some cases. He notes that the NDRC issued ratings in mid-August showing nine provinces as performing poorly based on H1 energy usage, and reportedly intensified its efforts to bring underperformers into line in mid-September.

Based on the number of provinces (9 in NDRC ‘red’ classification) and share of industrial activity affected (Goldman estimates 44%), as well as informed assumptions about the extent of the cutbacks, the bank has estimated the hit to industrial production and overall economic activity for the remainder of the year. The bank’s initial estimate is roughly a 1 percentage-point annualized hit to Q3 GDP growth and double this impact on Q4 growth. The bank then also adjusted its fiscal deficit estimates to reflect a smaller augmented deficit

for 2021 (11.0%, vs 11.6% previously), accounted for by a lower deficit in the second half of the year: “This trims our growth assumption by about 25bp in Q3 and 50bp in Q4, given a relatively low multiplier and typical lags.”

Putting it all together, Goldman’s new growth forecasts for Q3 shrink to flat, or 0% qoq (4.8% yoy), for Q4 to 6% qoq ann (3.2% yoy), and for 2021 as a whole to 7.8% (down from 5.1%, 4.1%, and 8.2% yoy previously.) Here, Goldman caveats that “considerable uncertainty” remains with respect to the fourth quarter, with both upside and downside risks relating principally to the government’s approach to managing the Evergrande stresses, the strictness of environmental target enforcement and the degree of policy easing. In short, how Beijing responds will impact the forecast. Regardless of said response, however, Goldman also takes down its 2022 GDP growth forecast to 5.5% yoy, well below China’s new redline in the 6% range.

* * *

Elaborating further, Goldman writes that in recent weeks markets have been focused on developments with respect to Evergrande, its real estate development business, and risks to the broader Chinese property sector. The downward pressures on property sales and construction have added to a myriad of other headwinds for the economy including a relatively tight macro policy stance (epitomized by a balanced official fiscal budget in H1), Covid-related restrictions to counter local outbreaks, and regulatory tightening across a range of other sectors.

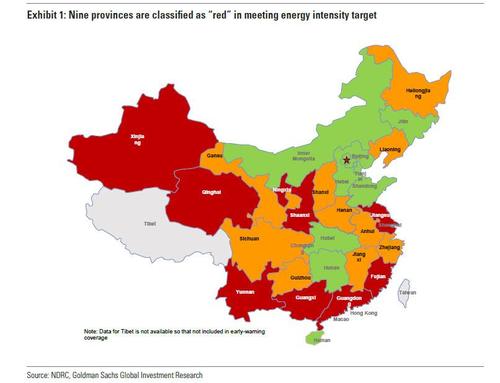

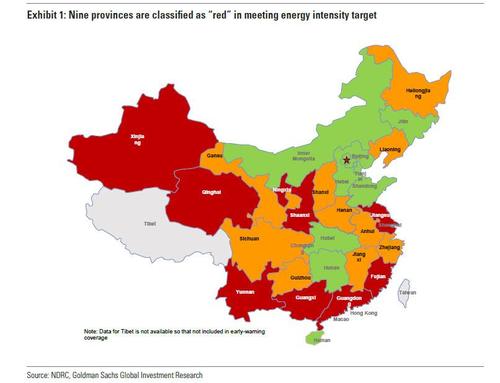

To this, we can now add a “new but tightening” constraint on growth from increased regulatory pressure to meet environmental targets for energy consumption and energy intensity (the so-called “dual controls”). As part of the country’s longer-term goal to reach peak carbon emissions by 2030, policymakers formulated shorter term targets for 2021 in March’s Government Work Report – including a 3% reduction in energy intensity of GDP this year. The National Development and Reform Commission (NDRC) monitors these at the provincial level on a quarterly basis. In August, it released a report classifying 9 provinces as category “red” – having missed their H1 targets, including Qinghai, Ningxia, Guangxi, Guangdong, Fujian, Xinjiang, Yunnan, Shaanxi and Jiangsu (Exhibit 1). Another 10 provinces were classified as “yellow”. In mid-September, the NDRC published a plan for “dual controls” and was reported to pressure provinces that had lagged behind to curb energy use.

Why did the energy use targets become binding so soon after being implemented?

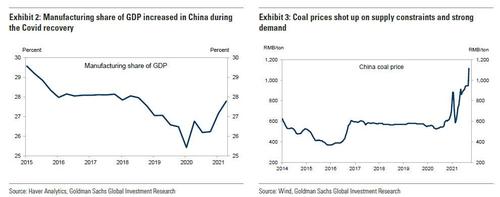

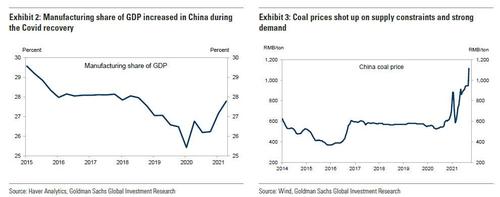

While it presumably was not the intention of policymakers to provoke a sharp tightening, at least when the goals were initially formulated, the peculiar nature of the Covid shock has made the economy more energy-intensive, at least temporarily. The boom in exports has boosted energy-intensive manufacturing industries (Exhibit 2), while Covid-related restrictions have primarily affected interaction-intensive service businesses. Meanwhile, efforts to reduce coal-fired related emissions and a reduction in coal imports have affected supply levels at least on the margin, contributing to the sharp increase in prices discussed earlier.

What follows below is Goldman’s attempt to quantify the impact of these production cutbacks on growth in Q3 and Q4.

First, quantifying the impact of energy-related production cuts.

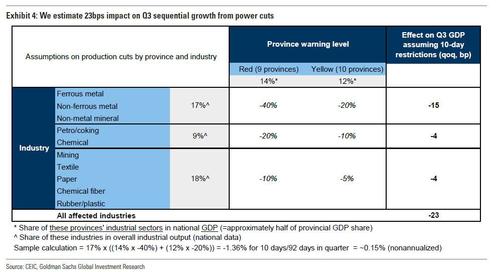

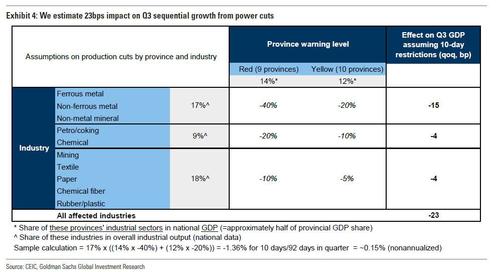

Given the uncertainty associated with the degree and duration of production cuts, Goldman has made a number of simplifying assumptions to size the impact on GDP. Exhibit 4 displays these assumptions and calculations.

First, the bank categorizes affected regions by their 1H 21 energy control ratings given by the NDRC. For the nine provinces where the rating is red, the local governments need to aggressively reduce energy consumption to meet the year-end target and we assume the largest production cuts in those provinces. This means even more pain is coming.

Second, Goldman divides industries by their energy intensity. For ferrous metals, non-ferrous metals and non-metal mineral products, the NDRC labels them as “high energy intensity” sectors and they are also cited most frequently in the news related to the latest power cuts (see here for example). Therefore, the bank assumes the sharpest production cuts (20-40%) in these three industries. Petroleum, coking & nuclear fuel and chemical material & product are also labeled as “high energy intensity” sectors, and are likely to suffer medium levels of production cuts (10-20%). Mining, textile, paper making, chemical fiber and rubber & plastic product require significant energy inputs and have been quoted in news articles as well. Goldman assumes 5-10% of production cuts depending on the province for these industries.

Altogether, Goldman expects the 10 days of production cuts at the end of September to reduce real GDP growth by nearly one percentage point (annualized) in Q3. The rightmost column in Exhibit 4 shows the hit to the level of GDP in Q3 for each set of industries; these sum to 23bp, and given this is a quarter-on-quarter change, the annualized change is slightly less than one percentage point (92bp).

Assuming the production cuts continue in Q4 and affect 10 days per month, they would reduce Q4 real GDP growth by about 1.8% sequentially. Here, Goldman hands out the usual caveats: namely that there is a great deal of uncertainty in our estimates. On the one hand, the bank assumes no places outside of the red and yellow provinces and no industries beyond the 10 industries mentioned above are affected, which will likely underestimate the actual production impact. On the other hand, affected companies may resort to shifting maintenance timing in response to power cuts and production may increase in provinces with non-binding energy caps, leading to less damage to overall growth.

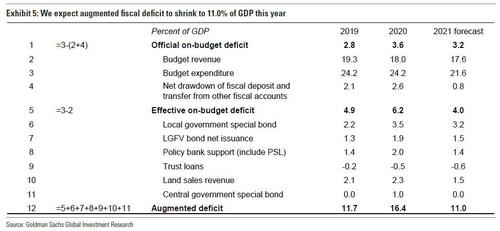

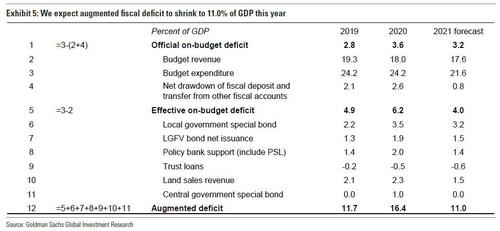

Cutting fiscal deficit forecast

After Chinese authorities quickly unwound the macro policy easing deployed in the first half of 2020, credit growth decelerated, excess liquidity was drained, and the fiscal deficit declined. In fact, fiscal policy normalized so quickly that the country ran an official deficit of zero in the first half of the year. Goldman had expected some reduction in the overall fiscal deficit, but the tighter-than-expected H1 caused the bank to revise its deficit estimate for 2021 lower. While there has been some fiscal easing in July and August, this partly reflects typical seasonal patterns and the deficit is tracking below these downwardly-revised estimates. Significant off-budget elements of the augmented deficit including policy bank lending, trust lending, and land sales are tracking below the bank’s forecasts, and the latter in particular seems likely to continue to underperform given the ongoing property market tightening and failed land auctions seen in recent months. On the other hand, local government special bond issuance has accelerated somewhat but remains below the pace needed to fully utilize this year’s quota. Therefore, Goldman is revising a second time, and moving its forecast for the full-year augmented deficit to 11.0% from 11.6% previously.

Adjusting the new second-half deficit forecasts 1.2% lower and applying a multiplier of 0.2 (as well as a modest lag to some spending), Goldman now estimates an impact on qoq annualized growth of roughly -1/4pp in Q3 and -1/2pp in Q4.

The new GDP growth forecasts

Combining these new estimates for the impact of supply-side cuts to energy-intensive production and slightly less support from fiscal policy, Goldman cuts its growth forecasts for:

- Q3 to 0% (qoq annualized), from +1.3% previously,

- Q4 to 6.0% annualized, from 8.5% previously.

As a result, Goldman’s year-over-year forecasts are now just 4.8% for Q3, 3.2% for Q4, and 7.8% for 2021 as a whole.

Finally, the lower starting point for early 2022 activity pulls the growth forecast for that year down one tenth, to 5.5%, despite modestly stronger sequential growth as restrictions become less binding and policy eases.

Uncertainties and policy response

While the third quarter is nearly over, uncertainty around the Q4 pace remains very large, and a lot of this comes down to the stance of both macro and regulatory policy, i.e., Beijing’s reponse. Key drivers of the Q4 outcome will include the timing and extent of:

- government measures to stabilize housing sector activity and stretch out the deleveraging in the property sector,

- any temporary relaxation of regulatory pressures to meet energy use targets, and/or

- macro policy support.

Each of these factors could materialize on either the positive or negative side relative to these new reduced growth forecasts.

https://www.zerohedge.com/markets/goldman-cuts-chinas-q3-gdp-growth-0-amid-growing-energy-crisis

September 28, 2021

Everyone is Analyzing China Lately

Goldman Cuts China’s Q3 GDP Growth To 0% As A Result Of Growing Energy Crisis

by Tyler DurdenMonday, Sep 27, 2021 – 07:04 PM

It’s not just Europe that is suffering the mother of all commodity and energy price shocks: slowly but surely a similar fate is befalling China, where a perfect storm of increased regulation, extremely tight global energy supply, the escalating trade spat with Australia, surging coal prices and a crackdown on carbon has led to energy shortages first at factories and manufacturers and more recently, mass blackouts hitting tens of millions of residents in at least three Chinese provinces (as we discussed earlier).

In our commentary to China’s growing energy problem we said that “while the blackouts starting to hit household power usage are at most an inconvenience, if one which may soon result in even more civil unrest if these are not contained, a bigger worry is that the already snarled supply chains could get even more broken, leading to even greater supply-disruption driven inflation.”

But there’s more than just supply chains: as Goldman’s China strategist Hui Shan writes in a note published late on Monday, “the recent sharp cuts to production in a range of high-energy-intensity industries add to the already significant downside pressures in the growth outlook.”

While the Goldman strategist explains more in detail further, the production cuts are due primarily to increased regulatory pressure on provinces to meet energy use targets for 2021 but also reflect surging energy prices in some cases. He notes that the NDRC issued ratings in mid-August showing nine provinces as performing poorly based on H1 energy usage, and reportedly intensified its efforts to bring underperformers into line in mid-September.

Based on the number of provinces (9 in NDRC ‘red’ classification) and share of industrial activity affected (Goldman estimates 44%), as well as informed assumptions about the extent of the cutbacks, the bank has estimated the hit to industrial production and overall economic activity for the remainder of the year. The bank’s initial estimate is roughly a 1 percentage-point annualized hit to Q3 GDP growth and double this impact on Q4 growth. The bank then also adjusted its fiscal deficit estimates to reflect a smaller augmented deficit

for 2021 (11.0%, vs 11.6% previously), accounted for by a lower deficit in the second half of the year: “This trims our growth assumption by about 25bp in Q3 and 50bp in Q4, given a relatively low multiplier and typical lags.”

Putting it all together, Goldman’s new growth forecasts for Q3 shrink to flat, or 0% qoq (4.8% yoy), for Q4 to 6% qoq ann (3.2% yoy), and for 2021 as a whole to 7.8% (down from 5.1%, 4.1%, and 8.2% yoy previously.) Here, Goldman caveats that “considerable uncertainty” remains with respect to the fourth quarter, with both upside and downside risks relating principally to the government’s approach to managing the Evergrande stresses, the strictness of environmental target enforcement and the degree of policy easing. In short, how Beijing responds will impact the forecast. Regardless of said response, however, Goldman also takes down its 2022 GDP growth forecast to 5.5% yoy, well below China’s new redline in the 6% range.

* * *

Elaborating further, Goldman writes that in recent weeks markets have been focused on developments with respect to Evergrande, its real estate development business, and risks to the broader Chinese property sector. The downward pressures on property sales and construction have added to a myriad of other headwinds for the economy including a relatively tight macro policy stance (epitomized by a balanced official fiscal budget in H1), Covid-related restrictions to counter local outbreaks, and regulatory tightening across a range of other sectors.

To this, we can now add a “new but tightening” constraint on growth from increased regulatory pressure to meet environmental targets for energy consumption and energy intensity (the so-called “dual controls”). As part of the country’s longer-term goal to reach peak carbon emissions by 2030, policymakers formulated shorter term targets for 2021 in March’s Government Work Report – including a 3% reduction in energy intensity of GDP this year. The National Development and Reform Commission (NDRC) monitors these at the provincial level on a quarterly basis. In August, it released a report classifying 9 provinces as category “red” – having missed their H1 targets, including Qinghai, Ningxia, Guangxi, Guangdong, Fujian, Xinjiang, Yunnan, Shaanxi and Jiangsu (Exhibit 1). Another 10 provinces were classified as “yellow”. In mid-September, the NDRC published a plan for “dual controls” and was reported to pressure provinces that had lagged behind to curb energy use.

Why did the energy use targets become binding so soon after being implemented?

While it presumably was not the intention of policymakers to provoke a sharp tightening, at least when the goals were initially formulated, the peculiar nature of the Covid shock has made the economy more energy-intensive, at least temporarily. The boom in exports has boosted energy-intensive manufacturing industries (Exhibit 2), while Covid-related restrictions have primarily affected interaction-intensive service businesses. Meanwhile, efforts to reduce coal-fired related emissions and a reduction in coal imports have affected supply levels at least on the margin, contributing to the sharp increase in prices discussed earlier.

What follows below is Goldman’s attempt to quantify the impact of these production cutbacks on growth in Q3 and Q4.

First, quantifying the impact of energy-related production cuts.

Given the uncertainty associated with the degree and duration of production cuts, Goldman has made a number of simplifying assumptions to size the impact on GDP. Exhibit 4 displays these assumptions and calculations.

First, the bank categorizes affected regions by their 1H 21 energy control ratings given by the NDRC. For the nine provinces where the rating is red, the local governments need to aggressively reduce energy consumption to meet the year-end target and we assume the largest production cuts in those provinces. This means even more pain is coming.

Second, Goldman divides industries by their energy intensity. For ferrous metals, non-ferrous metals and non-metal mineral products, the NDRC labels them as “high energy intensity” sectors and they are also cited most frequently in the news related to the latest power cuts (see here for example). Therefore, the bank assumes the sharpest production cuts (20-40%) in these three industries. Petroleum, coking & nuclear fuel and chemical material & product are also labeled as “high energy intensity” sectors, and are likely to suffer medium levels of production cuts (10-20%). Mining, textile, paper making, chemical fiber and rubber & plastic product require significant energy inputs and have been quoted in news articles as well. Goldman assumes 5-10% of production cuts depending on the province for these industries.

Altogether, Goldman expects the 10 days of production cuts at the end of September to reduce real GDP growth by nearly one percentage point (annualized) in Q3. The rightmost column in Exhibit 4 shows the hit to the level of GDP in Q3 for each set of industries; these sum to 23bp, and given this is a quarter-on-quarter change, the annualized change is slightly less than one percentage point (92bp).

Assuming the production cuts continue in Q4 and affect 10 days per month, they would reduce Q4 real GDP growth by about 1.8% sequentially. Here, Goldman hands out the usual caveats: namely that there is a great deal of uncertainty in our estimates. On the one hand, the bank assumes no places outside of the red and yellow provinces and no industries beyond the 10 industries mentioned above are affected, which will likely underestimate the actual production impact. On the other hand, affected companies may resort to shifting maintenance timing in response to power cuts and production may increase in provinces with non-binding energy caps, leading to less damage to overall growth.

Cutting fiscal deficit forecast

After Chinese authorities quickly unwound the macro policy easing deployed in the first half of 2020, credit growth decelerated, excess liquidity was drained, and the fiscal deficit declined. In fact, fiscal policy normalized so quickly that the country ran an official deficit of zero in the first half of the year. Goldman had expected some reduction in the overall fiscal deficit, but the tighter-than-expected H1 caused the bank to revise its deficit estimate for 2021 lower. While there has been some fiscal easing in July and August, this partly reflects typical seasonal patterns and the deficit is tracking below these downwardly-revised estimates. Significant off-budget elements of the augmented deficit including policy bank lending, trust lending, and land sales are tracking below the bank’s forecasts, and the latter in particular seems likely to continue to underperform given the ongoing property market tightening and failed land auctions seen in recent months. On the other hand, local government special bond issuance has accelerated somewhat but remains below the pace needed to fully utilize this year’s quota. Therefore, Goldman is revising a second time, and moving its forecast for the full-year augmented deficit to 11.0% from 11.6% previously.

Adjusting the new second-half deficit forecasts 1.2% lower and applying a multiplier of 0.2 (as well as a modest lag to some spending), Goldman now estimates an impact on qoq annualized growth of roughly -1/4pp in Q3 and -1/2pp in Q4.

The new GDP growth forecasts

Combining these new estimates for the impact of supply-side cuts to energy-intensive production and slightly less support from fiscal policy, Goldman cuts its growth forecasts for:

- Q3 to 0% (qoq annualized), from +1.3% previously,

- Q4 to 6.0% annualized, from 8.5% previously.

As a result, Goldman’s year-over-year forecasts are now just 4.8% for Q3, 3.2% for Q4, and 7.8% for 2021 as a whole.

Finally, the lower starting point for early 2022 activity pulls the growth forecast for that year down one tenth, to 5.5%, despite modestly stronger sequential growth as restrictions become less binding and policy eases.

Uncertainties and policy response

While the third quarter is nearly over, uncertainty around the Q4 pace remains very large, and a lot of this comes down to the stance of both macro and regulatory policy, i.e., Beijing’s reponse. Key drivers of the Q4 outcome will include the timing and extent of:

- government measures to stabilize housing sector activity and stretch out the deleveraging in the property sector,

- any temporary relaxation of regulatory pressures to meet energy use targets, and/or

- macro policy support.

Each of these factors could materialize on either the positive or negative side relative to these new reduced growth forecasts.

https://www.zerohedge.com/markets/goldman-cuts-chinas-q3-gdp-growth-0-amid-growing-energy-crisis

September 27, 2021

Chinese Spandex Update

Text size

Spandex prices continued surging in recent one year and current price has hit the highest level since 2008. Recently, export orders did not chase up smoothly and domestic demand was soft. Some dealers started revising down price. Will spandex price plunge later? Does market fundamentals of spandex change?  Supply There will be above 110kt/year of new spandex capacity to be launched in the second half of 2021 in Chinese mainland and it may bring about 30kt of production increase according to the startup time. By Sep 26, the operating rate of spandex plants declined to 93% from 97% in end-Aug. The control of total amount and the intensity of energy consumption is expected to affect spandex supply in short run. Some spandex plants scaled down production by around 10-40%. Xiamen Lilong suspended production due to the pandemic, affecting near 2% of spandex operation rate. Most old spandex units are still expected to run at above 90% of capacity and new units will gradually start operation. Supply There will be above 110kt/year of new spandex capacity to be launched in the second half of 2021 in Chinese mainland and it may bring about 30kt of production increase according to the startup time. By Sep 26, the operating rate of spandex plants declined to 93% from 97% in end-Aug. The control of total amount and the intensity of energy consumption is expected to affect spandex supply in short run. Some spandex plants scaled down production by around 10-40%. Xiamen Lilong suspended production due to the pandemic, affecting near 2% of spandex operation rate. Most old spandex units are still expected to run at above 90% of capacity and new units will gradually start operation. Spandex production is anticipated to gradually ascend in Q4.  Inventory The spandex inventory inched up but remained low now (the normal level was 30 days), supportive to price. By Sep 26, spandex inventory rose by around 8.5 days to above 13 days compared with early-Aug. Supply tightness of conventional spandex varieties has eased, while stocks of medium-to-high denier spandex rose rapidly. The order change still should be concerned in Oct. If orders chase up, spandex inventory may accumulate slowly even if fabric mills only purchase spandex on a need-to-basis. That means price of spandex may be late to reduce. The price competition is supposed to be fierce again if the gap between production and sales expands demand. Inventory The spandex inventory inched up but remained low now (the normal level was 30 days), supportive to price. By Sep 26, spandex inventory rose by around 8.5 days to above 13 days compared with early-Aug. Supply tightness of conventional spandex varieties has eased, while stocks of medium-to-high denier spandex rose rapidly. The order change still should be concerned in Oct. If orders chase up, spandex inventory may accumulate slowly even if fabric mills only purchase spandex on a need-to-basis. That means price of spandex may be late to reduce. The price competition is supposed to be fierce again if the gap between production and sales expands demand.The tempo of traditional peak season and dull season has been disrupted by the pandemic. The operating rate of downstream fabric mills was around 20 percentage points higher on the year in Jan-Aug, 2021 and around 10 percentage points higher than the 2019 level. However, the run rate apparently dipped after Aug. Affected by the control of total amount and intensity of energy consumption, dyeing plants’ operating rate obviously dropped in Zhejiang and Jiangsu, which will be bearish for the later operating rate of fabric mills.  The inventory of elastic fabrics was not high now. Stocks of some nylon/spandex air covered yarn, dralon fabrics and small circular knitting fabrics were above 1 month, mainly for the production of autumn and winter clothes. The stocks of high-density circular knitted fabric, polyester/spandex air covered yarn, cotton core-spun yarn and warp knitting super soft fabric were at 10-15 days. Downstream buyers were unwilling to hoard up stocks when price of polyester and cotton was weak and that of NFY rose limitedly. The inventory of elastic fabrics was not high now. Stocks of some nylon/spandex air covered yarn, dralon fabrics and small circular knitting fabrics were above 1 month, mainly for the production of autumn and winter clothes. The stocks of high-density circular knitted fabric, polyester/spandex air covered yarn, cotton core-spun yarn and warp knitting super soft fabric were at 10-15 days. Downstream buyers were unwilling to hoard up stocks when price of polyester and cotton was weak and that of NFY rose limitedly. Price of spandex stopped rising and turned to shiver recently. Supported by low inventory, stable spandex price was supportive to the stabilizing of grey fabric price and the processing fee of covered yarn. If spandex price dips apparently, earlier spandex inventory will be depreciated and it will have negative influence on later orders for fabrics. Cost Prices of PTMEG and BDO apparently rose and major feedstock cost of spandex was above 41,000yuan/mt for the first time, while spandex price shivered at high level. The price spread between spandex and its major feedstock has apparently narrowed to 7,500yuan/mt since end-Jul. Spandex price may be peaked affected by limited downstream orders and the control of total amount and intensity of energy consumption. Weakening demand surrenders weaker support to spandex price. Some spandex suppliers have revised down price. Spandex market are turning to be buyers’ market. Many buyers require discounts in actual transactions. Few dealers and fabric mills start underselling spandex. Price of spandex is not expected to plunge in short run supported by low inventory and firm feedstock price. New spandex units are scheduled to gradually commission operation and stocks of spandex may not rise much in short run. Therefore, price of spandex is expected to be firm in short run but weak in long run. |

https://www.ccfgroup.com/newscenter/newsview.php?Class_ID=D00000&Info_ID=2021092730047

September 27, 2021

Chinese Spandex Update

Text size

Spandex prices continued surging in recent one year and current price has hit the highest level since 2008. Recently, export orders did not chase up smoothly and domestic demand was soft. Some dealers started revising down price. Will spandex price plunge later? Does market fundamentals of spandex change?  Supply There will be above 110kt/year of new spandex capacity to be launched in the second half of 2021 in Chinese mainland and it may bring about 30kt of production increase according to the startup time. By Sep 26, the operating rate of spandex plants declined to 93% from 97% in end-Aug. The control of total amount and the intensity of energy consumption is expected to affect spandex supply in short run. Some spandex plants scaled down production by around 10-40%. Xiamen Lilong suspended production due to the pandemic, affecting near 2% of spandex operation rate. Most old spandex units are still expected to run at above 90% of capacity and new units will gradually start operation. Supply There will be above 110kt/year of new spandex capacity to be launched in the second half of 2021 in Chinese mainland and it may bring about 30kt of production increase according to the startup time. By Sep 26, the operating rate of spandex plants declined to 93% from 97% in end-Aug. The control of total amount and the intensity of energy consumption is expected to affect spandex supply in short run. Some spandex plants scaled down production by around 10-40%. Xiamen Lilong suspended production due to the pandemic, affecting near 2% of spandex operation rate. Most old spandex units are still expected to run at above 90% of capacity and new units will gradually start operation. Spandex production is anticipated to gradually ascend in Q4.  Inventory The spandex inventory inched up but remained low now (the normal level was 30 days), supportive to price. By Sep 26, spandex inventory rose by around 8.5 days to above 13 days compared with early-Aug. Supply tightness of conventional spandex varieties has eased, while stocks of medium-to-high denier spandex rose rapidly. The order change still should be concerned in Oct. If orders chase up, spandex inventory may accumulate slowly even if fabric mills only purchase spandex on a need-to-basis. That means price of spandex may be late to reduce. The price competition is supposed to be fierce again if the gap between production and sales expands demand. Inventory The spandex inventory inched up but remained low now (the normal level was 30 days), supportive to price. By Sep 26, spandex inventory rose by around 8.5 days to above 13 days compared with early-Aug. Supply tightness of conventional spandex varieties has eased, while stocks of medium-to-high denier spandex rose rapidly. The order change still should be concerned in Oct. If orders chase up, spandex inventory may accumulate slowly even if fabric mills only purchase spandex on a need-to-basis. That means price of spandex may be late to reduce. The price competition is supposed to be fierce again if the gap between production and sales expands demand.The tempo of traditional peak season and dull season has been disrupted by the pandemic. The operating rate of downstream fabric mills was around 20 percentage points higher on the year in Jan-Aug, 2021 and around 10 percentage points higher than the 2019 level. However, the run rate apparently dipped after Aug. Affected by the control of total amount and intensity of energy consumption, dyeing plants’ operating rate obviously dropped in Zhejiang and Jiangsu, which will be bearish for the later operating rate of fabric mills.  The inventory of elastic fabrics was not high now. Stocks of some nylon/spandex air covered yarn, dralon fabrics and small circular knitting fabrics were above 1 month, mainly for the production of autumn and winter clothes. The stocks of high-density circular knitted fabric, polyester/spandex air covered yarn, cotton core-spun yarn and warp knitting super soft fabric were at 10-15 days. Downstream buyers were unwilling to hoard up stocks when price of polyester and cotton was weak and that of NFY rose limitedly. The inventory of elastic fabrics was not high now. Stocks of some nylon/spandex air covered yarn, dralon fabrics and small circular knitting fabrics were above 1 month, mainly for the production of autumn and winter clothes. The stocks of high-density circular knitted fabric, polyester/spandex air covered yarn, cotton core-spun yarn and warp knitting super soft fabric were at 10-15 days. Downstream buyers were unwilling to hoard up stocks when price of polyester and cotton was weak and that of NFY rose limitedly. Price of spandex stopped rising and turned to shiver recently. Supported by low inventory, stable spandex price was supportive to the stabilizing of grey fabric price and the processing fee of covered yarn. If spandex price dips apparently, earlier spandex inventory will be depreciated and it will have negative influence on later orders for fabrics. Cost Prices of PTMEG and BDO apparently rose and major feedstock cost of spandex was above 41,000yuan/mt for the first time, while spandex price shivered at high level. The price spread between spandex and its major feedstock has apparently narrowed to 7,500yuan/mt since end-Jul. Spandex price may be peaked affected by limited downstream orders and the control of total amount and intensity of energy consumption. Weakening demand surrenders weaker support to spandex price. Some spandex suppliers have revised down price. Spandex market are turning to be buyers’ market. Many buyers require discounts in actual transactions. Few dealers and fabric mills start underselling spandex. Price of spandex is not expected to plunge in short run supported by low inventory and firm feedstock price. New spandex units are scheduled to gradually commission operation and stocks of spandex may not rise much in short run. Therefore, price of spandex is expected to be firm in short run but weak in long run. |

https://www.ccfgroup.com/newscenter/newsview.php?Class_ID=D00000&Info_ID=2021092730047