Asian Markets

February 14, 2023

China TDI Price Forecast for 2023

China TDI Price Forecast for 2023

PUdaily | Updated: February 14, 2023

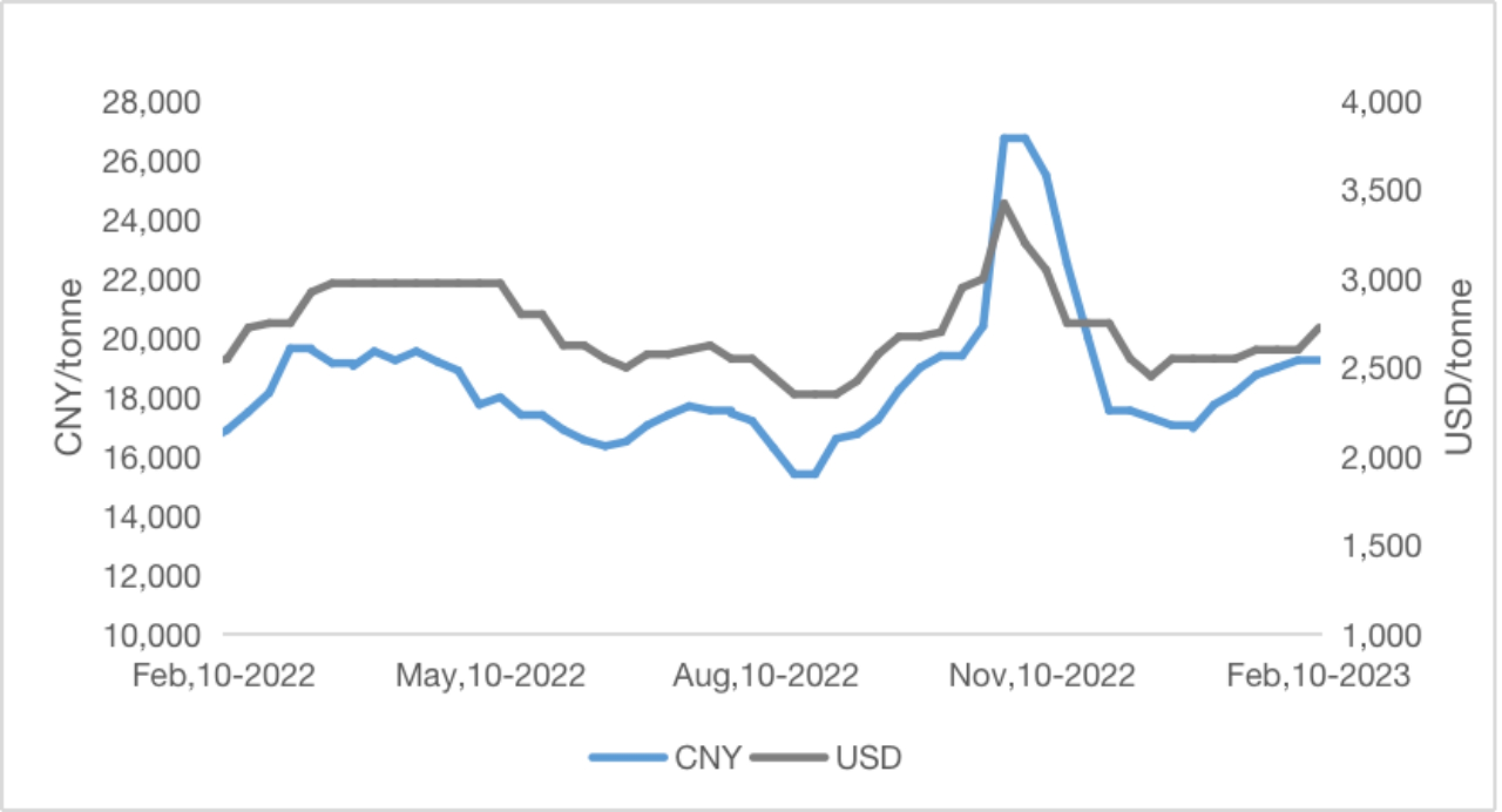

After returning from the Spring Festival holiday in 2023, the already high TDI price not only did not fall, but began another round of rapid rise: Covestro and BASF guidance prices increased sharply, and the market rumored that Wanhua Chemical will permanently close the old TDI production plant in Fujian on February 1. At the end of January, the market price rose rapidly to 20500~21000 CNY/tonne. However, after the Lantern Festival, the downstream industry basically resumed work, and was cautious in the face of high prices, and just needed procurement. Subsequently, as the trading continued to be light, some traders began to waver, driven by the low-price shipment of the profit order, some chose to let the profit shipment, the market price loosened slightly, the quotation range converged significantly, and the market price returned to around 20200~20600 CNY/tonne.

Table 1 Price influencing factors and forecast of China TDI market in2023

For the subsequent price trend, Pudaily combined the raw material side, supply side and demand side information to predict the TDI market price for the whole year of 2023:

Table 1 :Influencing Factors & Forecast for China TDI Market Price in 2023

| Influencing Factor | Impact on TDI Price | |

| Feedstock | It is projected that the impact of Russia-Ukraine conflict and OPEC’s oil output cuts would continue, and global crude oil prices would fluctuate at high levels in 2023. | – |

| Supply | It’s expected that Gansu Yinguang’s new 150kT facility would resume production in February 2023, and Wanhua Chemical’s new 250kT facility in Fujian would be put into production in June 2023. | ↓↓↓ |

| Demand | Domestic demand: Under China’s principle of “houses for living in, not speculation”, the demand in the main downstream industry of TDI – upholstered furniture- is unlikely to increase significantly. However, in view of the liberalization of anti-epidemic measures, demand may recover somewhat under the government’s initiatives to stimulate consumption. | ↑ |

| External demand: As many foreign TDI facilities are outmoded, their overall supply capacity is declining, thereby widening the gap between supply and demand. Meanwhile, Chinese TDI suppliers and traders have paid more attention to exports in recent years, especially after China has lifted registration system for foreign trade authorization. China’s TDI exports are expected to maintain year-on-year growth in 2023. | ↑ | |

| Comprehensive Prediction | In 2023, China’s TDI market is expected to open high and move downward, with weak fluctuations. The demand in China is projected to revive in 2023, with a slight year-on-year increase. However, owing to the increase of 300kT TDI supply capacity, and the low possibility of substantial growth of Chinese and global economy, especially the demand in the upholstered furniture industry, Chinese TDI market is forecasted to be oversupplied, and prices may open high and decline weakly in 2023. TDI prices in China would move between CNY 14,000/tonne and CNY 20,000/tonne. |

NOTE: “↑” represents positive, “↓” represents negative, and “-” represents neutral. The more the number of arrows, the greater impact the influencing factor is likely to have.

On the whole, it is expected that China’s TDI price will open high and low in 2023, which will be weak and volatile. In summary, demand is expected to recover in 2023, with a slight year-on-year increase. However, due to the supply-side production capacity will increase by 300,000 tons, and the substantial growth of China and the global economy in 2023, especially the possibility of a substantial increase in demand in the upholstered furniture industry, the overall TDI market in 2023 has a high probability of supply exceeding demand, and the price may open high and go low, weak and volatile, and the expected operating range: 14,000 yuan / ton ~ 22,000 yuan / ton.

February 13, 2023

Wanhua Chemical 2022 Results

Wanhua Chemical Group: Net profit for 2022 about 16.239 billion yuan, down 34.12% YoY

NBD

13, February, 2023,16:20 GMT+8

NBD AI Bulletin – Wanhua Chemical Group Co Ltd (SH 600309, close price: 97.97 yuan) on February 13 briefed its annual results for 2022. Operating income for the year was about 165.565 billion yuan, showing an increase of 13.76% from a year ago. Net profit attributable to the shareholders of the listed company was about 16.239 billion yuan, down 34.12% year on year. Basic earnings per share was 5.17 yuan, showing a 34.14% reduction.

Wanhua Chemical Group Co Ltd’s chairman is Liao Zengtai, male, 60 years old, with a master’s degree; The general manager is Kou Guangwu, male, 57 years old, with a master’s degree.

As at the press time, the market value of Wanhua Chemical Group Co Ltd was 307.6 billion yuan.

(By Lan Suying)

http://www.nbdpress.com/articles/2023-02-13/44873.html

January 25, 2023

Chinese Propylene Oxide Review

2022 Year End Summary: China’s PO Market Review

PUdaily | Updated: January 17, 2023

The pandemic, coupled with tight global supplies of energy and food, impacted consumption and manufacturing activities in China in 2022. But China’s economy is expected to pick up in 2023 as the government efforts to stimulate economy are producing effects, including the shift in pandemic prevention and control policy, which enables the economy to emerge from the negative effects of the COVID-19, the demand to recover and the manufacturing activities to return to normal levels, as well as the development of policies to increase domestic demand, which will help offset the impact of decreased exports. And the low base in 2022 also lays a foundation for the robust economic recovery in 2023. It is expected that China’s economy will grow by over 5% in 2023.

In terms of the PU raw materials market, against the backdrop of global inflation, repeated COVID-19 outbreaks and start-up of new production capacities, in 2022 buyers gained more bargaining power the market supply and demand pattern has turned from up to down, and the PO market shows a trend of falling within a range and fluctuating in a narrow range.

China PO Prices

In 2022, manufacturers in Shandong continued to have the greatest impact on the changes in domestic PO prices. Offers in Shandong and North China averaged about CNY 10,163/tonne EXW in bulk in cash, down 38.3%. And those in East China averaged CNY 10,309/tonne DEL in bulk in cash, down 38.2%.

China PO Capacity & Output

In 2022, Taixing Yida Chemical saw successful trial run of its 150kt/a PO project, and Tianjin Bohai Chemical’s PO/SM plant, with an annual capacity of 200,000 tonnes for PO and 450,000 tons for SM, was also successfully commissioned, thus bringing the national PO capacity to 4.897 million tons per year, up 14% from prior year. Further capacity expansion can be expected as Zhejiang Petroleum and Chemical’s Phase II PO/SM project is under construction and Jiangsu Eastern Shenghong is planning its PO/SM facility project, with an annual capacity of 200,000 tonnes for PO and 450,000 tons for SM. China’s total PO output in 2022 hit a record high of 3.76 million tonnes, up 8.7 percent.

China PO Import & Export

According to the General Administration of Customs of China, China imported 290,000 tonnes of PO for the January-November period, down 26.3% year-on-year and mainly from Thailand and Japan. It exported 9,000 tonnes of PO for the same period, up 268.3% year-over-year and mainly to India and the United States.

In the year, some PO units in Saudi Arabia, Japan and South Korea, Thailand and European countries were shut for routine maintenance or forced to lower their production loads due to energy crisis and cost pressure. On the other hand, as domestic production capacity continued to expand, China’s dependence on imports had been significantly reduced. All this led to shrunk PO imports…

China PO Consumption

In 2022, China’s PO consumption rose by 4.2%. Although PO production increased significantly as new capacities came online, the demand failed to expand as rapidly. The lockdown in East China was lifted in the second quarter, but no significant recovery in demand followed in July. The supply remained ample, though individual manufacturers experienced fluctuations in their production. In 2022, PPG remained the largest consumer of PO, although PPG consumption decreased by 8.3%. It is followed by PG/DMC, propylene glycol ethers, flame retardant TCPP and isopropanolamine…

In 2023, Tianjin No. 3 Petrochemical Plant, Zhejiang Petrochemical &Chemical, Shandong Minxiang Chemical Technology and Shandong Jufeng New Energy Technology are likely to put into operation their new plants. In 2022, PO manufacturers again lowered their production loads in an attempt to boost the market, resulting in an industry operating rate of 55% to 68% excluding plants shut for maintenance. But the effectiveness was quite different than in 2021. The main reason is the fierce competition resulting from more new players entering the market in addition to the sluggish demand. As supply became increasingly ample, buyers gained more bargaining power and the profit margin was squeezed.

January 25, 2023

Southeast Asia MDI Report

Southeast Asia MDI Market and Dowmstream Sectors Review 2022

PUdaily | Updated: January 19, 2023

With higher vaccination coverage and loosening pandemic restrictions, most economies in Southeast Asia showed strong recovery momentum in the past year. In December 2022, the Asian Development Bank (ADB) gave out a supplement to its flagship Asian Development Outlook(ADO) 2022, which upgraded growth outlook for 2022 to 5.5% from 5.1% on robust economic performance in Malaysia, the Philippines, Thailand, and Vietnam in the third quarter. The report noted that the strong performance on consumption, exports and tourism in these economies boosted economic growth expectations for 2022.

Southeast Asia MDI Demand 2022

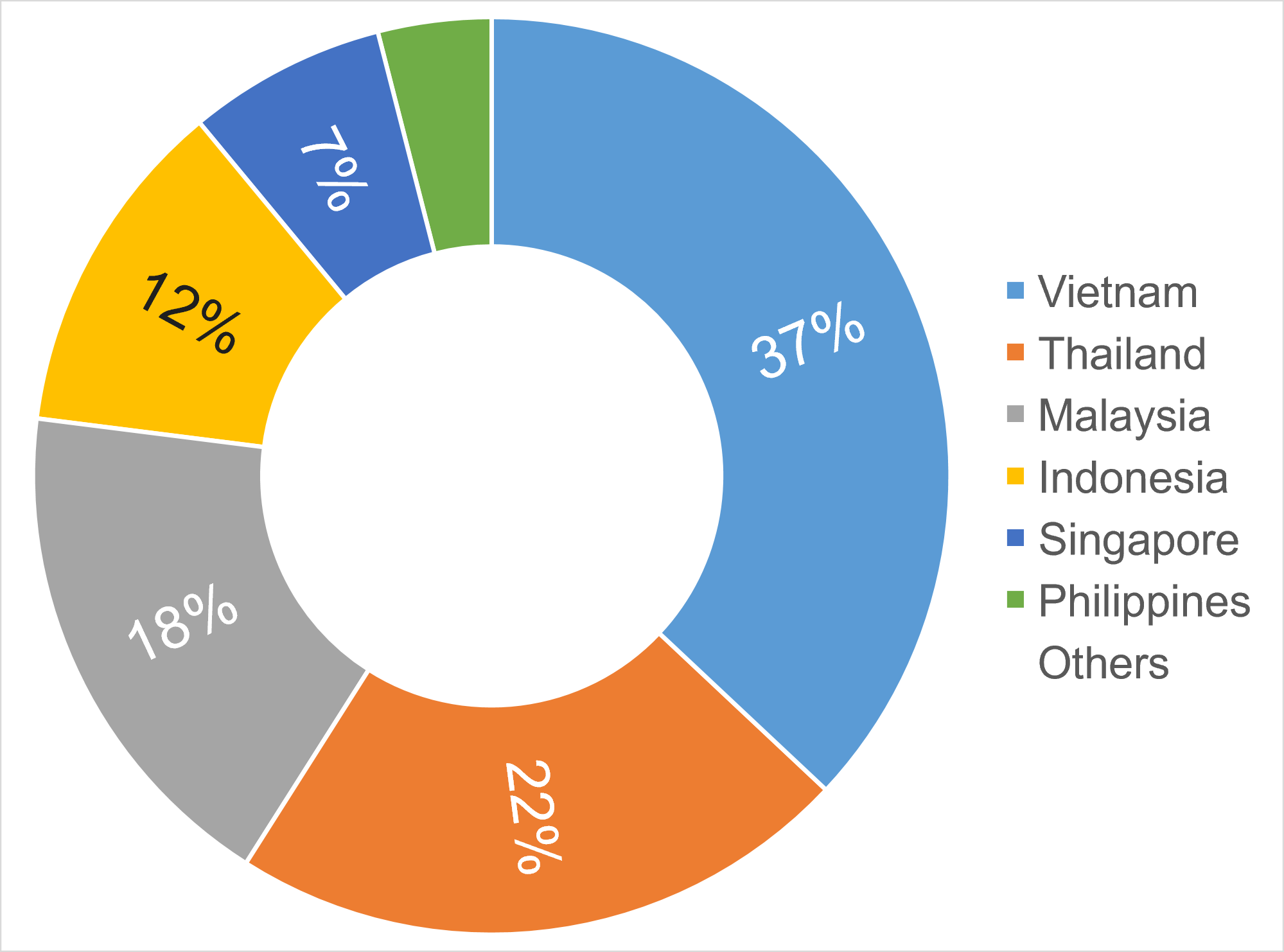

Without any MDI synthesizing facilities, Southeast Asia region mainly imports MDI products from China, Japan, South Korea and even from the Middle East and Europe. The major MDI suppliers include Chinese Wanhua Chemical, Japanese Tosoh, South Korean KMCI and BASF. Moreover, Middle Eastern firm Sadara’s PMDI is sold by Dow and SABIC. The supply of MDI exported from China, Japan and South Korea to Southeast Asia kept stable from 2018 to 2022. It is estimated that the total demand for MDI in Southeast Asia will be about 300kT in 2022, of which the demand for imported goods from China, Japan and South Korea will be around 260kT, basically the same as the previous year. Vietnam, Thailand and Malaysia are the top MDI consumers in Southeast Asia. In 2022, the year-on-year growth rates of MDI consumption in Vietnam and Malaysia were higher than the overall growth level of consumption in Southeast Asia.

Southeast Asian (Estimated) MDI Consumption by Country, 2022 (%)

Southeast Asian Major MDI Downstream Sectors

The main downstream sectors of PMDI in Southeast Asia are insulation panels, refrigerators & freezers, automobiles, etc. And the main downstream sectors of MMDI are PU resin for shoe sole and spandex. Vietnam, Thailand, Indonesia, Malaysia and Singapore are the top MDI consumers and also the major economies in the region. Southeast Asia countries have attracted significant foreign investment in recent years, owing to low costs on land and labor, stable political environment, robust economic development and preferential tariff rates.

Cold Chain Logistics (Insulation Panel): As one of the key strategic regions for global industrial transfer, the development of Southeast Asian countries is attracting much attention, and its cold chain logistics market is expected to grow by more than 12% in 2022-2027. Thailand’s refrigeration capacity totaled 940kT, and the refrigeration capacity of Indonesia and Myanmar was 370kT and 88kT respectively, according to a report of the Economic Research Institute for ASEAN and East Asia (ERIA). Increasing meat consumption is one of the main driving factor for the development of the cold chain industry in Southeast Asian countries. Malaysia’s poultry meat industry is largely self-sufficient, with an annual per capita consumption of nearly 50 kilograms.

Automobile: With a huge population and abundant natural resources, ASEAN is one of the fastest-growing consumer market, which, in turn, will drive the automobile market. From January to November 2022, auto outputs in ASEAN amounted to 4.06 million units, up 27.4% y/y. The top three auto producers are Indonesia, Thailand and Malaysia, contributing about 92.5% of total regional outputs. Thailand, the largest auto production base in Southeast Asia, produced 1.79 million vehicles from January to November 2022, up 16.9% y/y.

Summary:

The overall MDI consumption in Southeast Asia in 2022 kept unchanged compared with the previous year. It’s mainly because Southeast Asian manufacturing PMI is above 50% throughout the year and the demand in MDI downstream sectors didn’t weaken significantly. In addition, thanks to lower labor costs, more foreign-funded enterprises chose to enter the Southeast Asian market. In 2023, MDI consumption and its downstream sectors are projected to see a rise in Southeast Asia.

January 13, 2023

Chinese Spandex Review of 2022

2022 big events of spandex industry

Text size

| Macro environment was complex and changeable in 2022. Global economy decreased due to the raise of interest rate in US, energy price soared amid the Russia-Ukraine conflict and market liquidity weakened because of the repeat spread of COVID-19 pandemic in local China. Global economy faced high inflation and low growth rate, in stagnation stage. Spandex market was greatly affected by the macro environment in 2022. Demand for spandex was apparently insufficient. The weakness was transferred to upstream market from the downstream sector. Spandex market saw obviously worse price, operating rate, inventory and profit in 2022.Macro policies 1. Implementation of tax rate on spandex value chain in RCEP AgreementThe Regional Comprehensive Economic Partnership Agreement (RCEP) entered into force on January 1, 2022, mainly involving six ASEAN members, including Brunei, Cambodia, Laos, Singapore, Thailand and Vietnam, and four non-ASEAN members, including China, Japan, New Zealand and Australia.With the help of RCEP reciprocal tariffs, the growth rate of textile exports to Europe and the United States was greater than that to Europe and the United States. From January to October 2022, ASEAN accounted for 16.97% of China’s textile and apparel exports, surpassing the United States to become China’s largest export market, with an increase of 20.9 percent over the same period of last year; the United States took up 16.85%, with a decrease of 1.58 percent on annual basis; and the European Union accounted for 14.7%, with an increase of 4.73 percent year on year. 2023 is the second year of the entry into force of the RCEP, and trade terms and tariff dividends on exports to ASEAN will be further released. 2. Ministry of Industry and Information Technology and National Development and Reform Commission issued relevant guidance on chemical fiber and textileThe Ministry of Industry and Information Technology and the National Development and Reform Commission issued the guidance on the High-quality Development of the Chemical Fiber Industry on April 21, 2022 proposing that by 2025, the industrial added value of chemical fiber enterprises above scale will grow at an average annual rate of 5%. The proportion of chemical fiber output in the world will be basically stable. Upstream feedstock market 1. Capacity expansion 1) Shaanxi Shanhua’s BDO second phase alkynation efficiency improvement project starts operation successfully The second phase of the alkynation efficiency improvement project from Shaanxi Shanhua was successfully started up at one time in November, 2022, completed the activation of the catalyst, and produced qualified 1,4 butynediol. The second phase of BDO alkynation efficiency improvement project is a key project for Shaanxi Shanhua to improve both BDO production capacity and efficiency. 2)Inner Mongolia Dongjing commenced 280KTA BDO plant On November 24, 2022, after more than a year of intensive construction, Inner Mongolia Dongjing Biological Environmental Protection Technology Co., Ltd., located in Wuda Industrial Park of Wuhai, has successfully started up its 1,4-butanediol (BDO) plant with an annual output of 280000 ton. After a day of debugging, the purity has reached 99.91%, which indicated that Dongyuan Technology has become the world’s largest integrated production base of BDO with an annual BDO capacity at 380kt. 3) Wanhua Chemical’s MDI unit started production successfully in Fujian Wanhua Chemical Group Holding Company Wanhua Chemical (Fujian) Isocyanate Co., Ltd.’s 400kt/year MDI unit has successfully started operation on Dec 22, 2022, with qualified products available. This project will further optimize company’s MDI industrial layout and improve global industrial competitiveness. 2. New National Standard (2022 Version) for the PTMEG implemented The 2022 version of PTMEG new national standard, led by Sichuan Tianhua Fubon Chemical Co., Ltd., and jointly drafted by Chongqing Jianfeng New Materials Co., Ltd. Chiyuan Chemical Branch, Shaanxi Shanhua Coal Chemical Group Co., Ltd., CPP (Panjin) Co., Ltd., Dairen Chemical (Jiangsu) Co., Ltd., Xinjiang Blue Ridge Tunhe Energy Co., Ltd., Zhonglan Chengguang Chengdu testing Technology Co., Ltd. and CGN Juner (Zhejiang) New Materials Co., Ltd. has been issued and implemented from November, 2022.Spandex sector 1. Spandex capacity exceeded 1 million tons for the first time By the end of 2022, the capacity of spandex exceeded 1 million tons to be 1.0965 million tons/year in Chinese mainland, up by 12.9% or 125kt/year on the year. Three companies had new capacity in the first half of 2022, namely Hyosung Ningxia, Huafon Chongqing and Xinxiang Chemical Fiber, with total new capacity at 90kt/year. Four companies had new capacity in the second half of year, namely Tayho Ningxia, Zhuji Huahai, Xinxiang Chemical Fiber and Zhuji Qingrong, with total new capacity at 60kt/year. 25kt/year of capacity was eliminated at the end of 2022. The total increment of capacity was at 35kt/year combined with the new expansion and eliminated capacity in the second half of 2022.Spandex market saw extreme operation in 2022. New capacity expansion was big. However, some export orders flew to Southeast Asia and South Asia in the second and third quarter. Domestic and export demand was soft in the fourth quarter impacted by the spread of pandemic and the high inflation outside China. Demand for spandex saw a rare negative growth. The operating rate of spandex plants averaged at 76.4% in 2022, down by 18.2 percentage points on the year, with the highest and lowest level at 94% in mid-Mar and 55% in mid-Aug. 2. Huafon Group completed the M&A of bio-based business under DuPont On June 1, 2022, Beijing time, Huafon Group formally completed the delivery of the related business and technology of bio-based products spun off by DuPont of the United States. This is by far the largest overseas M&A transaction of Huafon Group. 3. Bangtai’s bio-based melt-spun spandex successfully passed the USDA Bio-based Product Certification On Jun 1, in order to realize the recycling of resources and build a sustainable future, Bangtai has a foothold in the field of new materials and plays a green role under the strategic goal of “Dual Carbon”. Bangtai’s technical team has successfully developed bio-based melt spinning spandex products and successfully passed the U.S. Department of Agriculture (USDA) Bio-based Product Certification! 4. Hyosung’s biological spandex certified by SGS On Jul 26, Hyosung is the world’s largest spandex manufacturer and the first global developer to commercialize biological spandex. Hyosung creora® bio-spandex has been certified by Standard Global Services (SGS) as an eco-product, ensuring that the product is made of plant materials and produced in a harmless and environmentally friendly environment. SGS is a leading inspection, accreditation, testing and certification organization and a globally recognized benchmark for quality and integrity. 5. The spread of pandemic affected the operation of some textile and apparel markets The COVID-19 pandemic had an obvious impact on the business of textiles and apparels in 2022. Some professional textile and apparel markets in Shanghai, Guangzhou, Hangzhou, Shenyang, Haicheng, Shaoxing, Xinjiang, Zhuzhou and Nantong were closed for a long time. 6. Textile companies went abroad to snatch orders At the end of the 2022, after China’s epidemic prevention and control measures were optimized, textile enterprises either set out on their own or joined the “order-grabbing regiment” organized by the government to get new orders and talk about new investment abroad so as to quickly expand market. |

http://www.ccfgroup.com/newscenter/newsview.php?Class_ID=D00000&Info_ID=2023011330026