Current Affairs

December 9, 2022

Rent Your Space Now

Remote-Work Revolution Has Wiped Out $453 Billion In Commercial Real Estate Value

by Tyler Durden

Thursday, Dec 08, 2022 – 07:20 PM

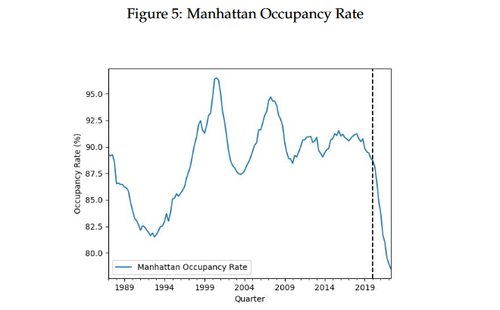

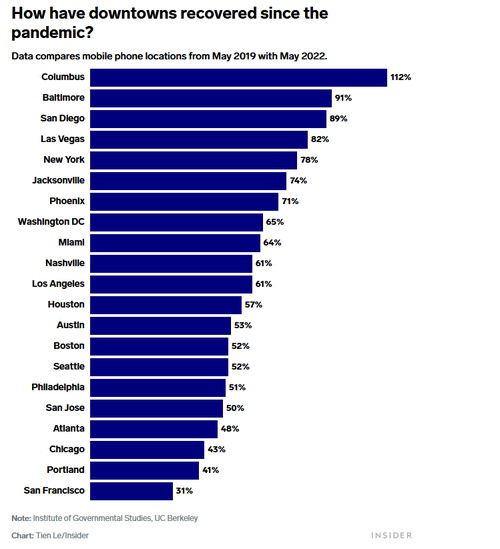

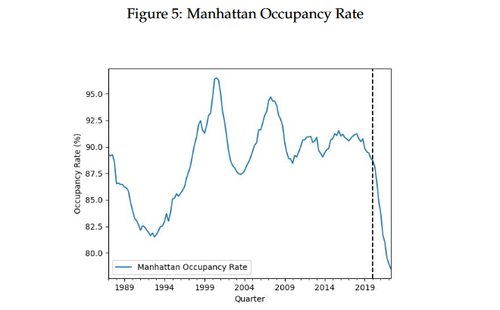

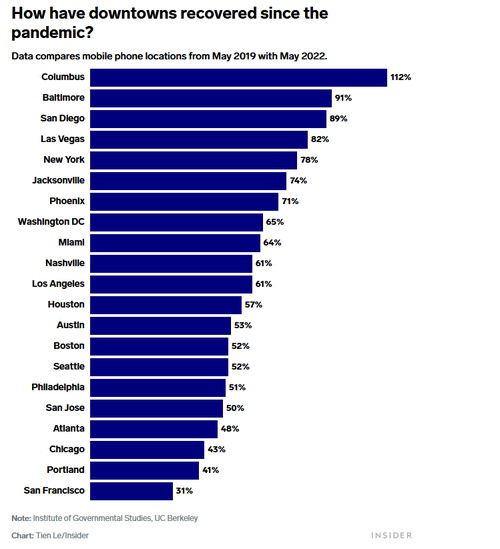

Leading up to the Covid-19 pandemic, roughly 95% of commercial office space was occupied across the United States, according to US National Bureau of Economic Research (NBER) – a nonprofit, non-government organization. By March 2020, occupancy plummeted to 10%, and has only recovered to 47%, according to a new NBER report which claims $453 billion in office commercial real estate value has been wiped out in an “office real estate apocalypse.”

Around the US, that resulted in a 17.5 percent decrease in lease revenue between January 2020, and May 2022, and not only because fewer offices were being occupied, but also because those that are being rented are going for shorter terms, lower prices per month, and a lot less floor space is needed as staff are told they can work from home for most or all the week.

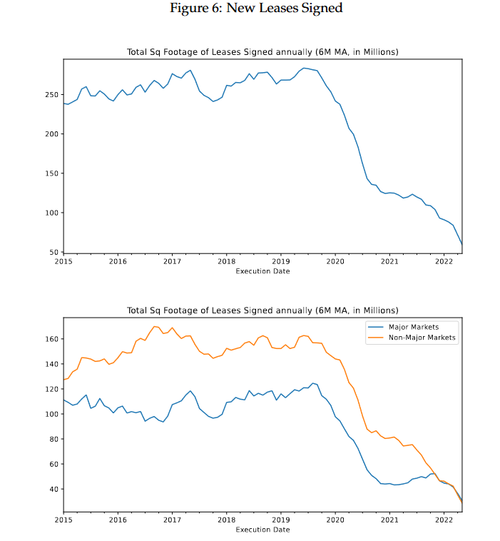

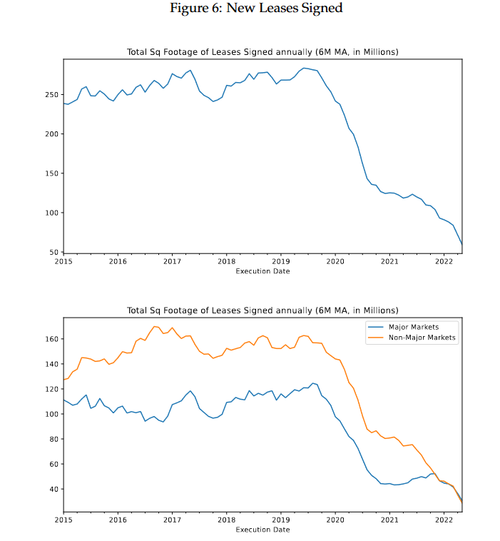

Prior to the pandemic, 253 million square feet were rented per year; as of May 2022, just 59 million square feet had been rented, NBER’s data indicates. “This indicates a massive drop in office demand from tenants who are actively making space decisions,” NBER said. –The Register

What’s more, while vacancy rates have hit a 30-year high, 61.7% of in-force commercial leases haven’t come up for renewal since the pandemic – meaning that “rents may not have bottomed out yet.”

What this means is that commercial real estate – a popular choice for pension fund managers and investors alike – may not be the best idea for the foreseeable future, given the continuing work-from-home options adopted by corporate America.

A common method used to invest in office real estate is commercial mortgage-backed securities (CMBS), which are managed and traded via commercial mortgage-backed indexes (CMBX) made up of pools of CMBSes.

According to NBER, more recent CMBXes tend to include a higher percentage of office collateral than earlier vintages. Those newer, office-heavy CMBXes, NBER said, are what’s losing the most money. -The Register

NBER says that in 2019, commercial real estate assets topped $4.7 trillion – offices being the largest component.

https://www.zerohedge.com/economics/remote-work-revolution-has-wiped-out-453-billion-commercial-real-estate-value

December 9, 2022

Rent Your Space Now

Remote-Work Revolution Has Wiped Out $453 Billion In Commercial Real Estate Value

by Tyler Durden

Thursday, Dec 08, 2022 – 07:20 PM

Leading up to the Covid-19 pandemic, roughly 95% of commercial office space was occupied across the United States, according to US National Bureau of Economic Research (NBER) – a nonprofit, non-government organization. By March 2020, occupancy plummeted to 10%, and has only recovered to 47%, according to a new NBER report which claims $453 billion in office commercial real estate value has been wiped out in an “office real estate apocalypse.”

Around the US, that resulted in a 17.5 percent decrease in lease revenue between January 2020, and May 2022, and not only because fewer offices were being occupied, but also because those that are being rented are going for shorter terms, lower prices per month, and a lot less floor space is needed as staff are told they can work from home for most or all the week.

Prior to the pandemic, 253 million square feet were rented per year; as of May 2022, just 59 million square feet had been rented, NBER’s data indicates. “This indicates a massive drop in office demand from tenants who are actively making space decisions,” NBER said. –The Register

What’s more, while vacancy rates have hit a 30-year high, 61.7% of in-force commercial leases haven’t come up for renewal since the pandemic – meaning that “rents may not have bottomed out yet.”

What this means is that commercial real estate – a popular choice for pension fund managers and investors alike – may not be the best idea for the foreseeable future, given the continuing work-from-home options adopted by corporate America.

A common method used to invest in office real estate is commercial mortgage-backed securities (CMBS), which are managed and traded via commercial mortgage-backed indexes (CMBX) made up of pools of CMBSes.

According to NBER, more recent CMBXes tend to include a higher percentage of office collateral than earlier vintages. Those newer, office-heavy CMBXes, NBER said, are what’s losing the most money. -The Register

NBER says that in 2019, commercial real estate assets topped $4.7 trillion – offices being the largest component.

https://www.zerohedge.com/economics/remote-work-revolution-has-wiped-out-453-billion-commercial-real-estate-value

December 8, 2022

The Last 747

End Of An Era: Final Boeing 747 Rolls Off Assembly Line

by Tyler Durden

Wednesday, Dec 07, 2022 – 08:00 PM

The last Boeing 747 jumbo jet rolled off the production line at the company’s factory in Everett, Washington, on Tuesday night, marking a close to a significant chapter in aviation history.

Aviation historians call the 747 the original jumbo jet was first produced in 1967. Three years later, Pan Am started flying the double-decker jumbo jet that could haul over 500 passengers worldwide.

“For more than half a century, tens of thousands of dedicated Boeing employees have designed and built this magnificent airplane that has truly changed the world. We are proud that this plane will continue to fly across the globe for years to come,” Kim Smith, Boeing vice president and general manager, 747 and 767 programs, wrote in a press release.

Last night, the 1,574th 747 rolled out of the Everett factory.

The 747 was once the premiere choice of aircraft for airlines and has since been replaced with a twin-engine, wide-body aircraft that is more fuel-efficient. Still, 341 of these jumbos are in use but only as freighters.

“The 747-8 is an incredibly capable aircraft, with capacity that is unmatched by any other freighter in production,” UPS wrote in a statement in 2020 when Boeing said production of the jet would end in late 2022.

“With a maximum payload of 307,000 lbs., we use them on long, high-volume routes, connecting Asia, North America, Europe and the Middle East,” the shipper continued.

The last 747 was sold to air freighter Atlas Air which will use the aircraft to haul goods worldwide.

https://www.zerohedge.com/markets/end-era-final-boeing-747-rolls-assembly-line

December 8, 2022

The Last 747

End Of An Era: Final Boeing 747 Rolls Off Assembly Line

by Tyler Durden

Wednesday, Dec 07, 2022 – 08:00 PM

The last Boeing 747 jumbo jet rolled off the production line at the company’s factory in Everett, Washington, on Tuesday night, marking a close to a significant chapter in aviation history.

Aviation historians call the 747 the original jumbo jet was first produced in 1967. Three years later, Pan Am started flying the double-decker jumbo jet that could haul over 500 passengers worldwide.

“For more than half a century, tens of thousands of dedicated Boeing employees have designed and built this magnificent airplane that has truly changed the world. We are proud that this plane will continue to fly across the globe for years to come,” Kim Smith, Boeing vice president and general manager, 747 and 767 programs, wrote in a press release.

Last night, the 1,574th 747 rolled out of the Everett factory.

The 747 was once the premiere choice of aircraft for airlines and has since been replaced with a twin-engine, wide-body aircraft that is more fuel-efficient. Still, 341 of these jumbos are in use but only as freighters.

“The 747-8 is an incredibly capable aircraft, with capacity that is unmatched by any other freighter in production,” UPS wrote in a statement in 2020 when Boeing said production of the jet would end in late 2022.

“With a maximum payload of 307,000 lbs., we use them on long, high-volume routes, connecting Asia, North America, Europe and the Middle East,” the shipper continued.

The last 747 was sold to air freighter Atlas Air which will use the aircraft to haul goods worldwide.

https://www.zerohedge.com/markets/end-era-final-boeing-747-rolls-assembly-line

December 7, 2022

Chemical Rail Traffic Update

North American chemical rail traffic fell by 3.2%

MOSCOW (MRC) — North American chemical rail traffic fell by 3.2% year on year to 40,467 railcar loadings for the week ended 26 November – marking a 10th consecutive decline, according to the latest freight rail data by the Association of American Railroads (AAR).

An increase in Canada was more than offset by declines in the US and Mexico. The four-week average for North American chemical rail traffic was at 45,860 railcar loadings.

Despite the 10th decline in a row, for the first 47 weeks of 2022 ended 26 November North American chemical railcar traffic was still up 1.2% year on year to 2,155,420 railcar loadings.

In the US, chemical railcar loadings represent about 20% of chemical transportation by tonnage, with trucks, barges and pipelines carrying the rest. In Canada, producers rely on rail to ship more than 70% of their products, with some exclusively using rail.

Shipments of chemicals, coal, motor vehicles and parts, nonmetallic minerals, and oil and oil products rose for the first 47 weeks, while shipments in all other freight railcar categories fell.

In related news, the US House of Representatives on Wednesday adopted a resolution aimed at averting a rail strike.

We remind, for the week ending November 19, 2022, total U.S. weekly rail traffic was 491,794 carloads and intermodal units, down 3.2 percent compared with the same week last year. Total carloads for the week ending November 19 were 235,887 carloads, down 0.6 percent compared with the same week in 2021, while U.S. weekly intermodal volume was 255,907 containers and trailers, down 5.6 percent compared to 2021.

mrchub.com

https://www.mrchub.com/news/405321-north-american-chemical-rail-traffic-fell-by-3.2-percent