The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

January 12, 2023

Spandex market may embrace a good start after LNY holiday

| The COVID-19 pandemic infection peak has been passed in fabric manufacturing bases in Zhejiang and Jiangsu. The worry of production resumption after the Lunar New Year’s (LNY) holiday has been mitigated. Buyers were active in purchasing spandex after the New Year’s Day. Price of PTMEG and MMDI stabilized and slightly rallied. Spandex market witnesses better supply, demand and cost. A good start after the Lunar New Year’s holiday may be deserved anticipation. In terms of price, the price of spandex 40D has been close to the historic bottom. Current price of spandex 40D has been higher than the low level in Sep 2,022. According to the data from CCFGroup, price of spandex 40D was at 32,000yuan/mt now, mainly discussed at 31,000-33,000yuan/mt. The discounts of some varieties have been canceled after inventory dropped substantially. Price of some medium-to-high end spandex 40D was at 33,000-36,000yuan/mt.  As for the feedstock cost, price of major feedstock PTMEG, BDO and MMDI all bottomed out. That meant the cost of spandex market climbed up. With rising price of BDO and in expectation of better demand, price of some PTMEG was required to rise by 2,000yuan/mt over Dec. Under the cost pressure, the discussion was in stagnation and the actual price increment was smaller at 500-1,000yuan/mt. Price of MMDI also rebounded. Wanhua Chemical updated liquid MMDI Jan nominations at 20,500yuan/mt, up by 500yuan/mt on the month.  From the angle of supply, the operating rate of spandex plants rose by 15 percentage points to 72% now from 57% before the New Year’s Day holiday, which was mainly driven by better sales in Jan, but it was still low compared with the same period in recent five years. From the angle of supply, the operating rate of spandex plants rose by 15 percentage points to 72% now from 57% before the New Year’s Day holiday, which was mainly driven by better sales in Jan, but it was still low compared with the same period in recent five years. More leading companies resumed operation from earlier production curtailment or suspension. Some big spandex plants will further ramp Looking at the inventory, the inventory of spandex was rapidly transferred to medium-to-downstream market. The inventory of spandex suppliers has reduced to 27 days, the second lowest during the corresponding period in recent five years. Some buyers were active in restocking even before the Lunar New Year’s Day holiday. Stocks fell rapidly in plants who cut or suspended much production before. Sellers reduced discounts. Some suppliers even controlled the volume of orders, worrying price of major feedstock to increase in Feb. Some fabric mills may continue replenishing after recouping some capital. The spandex inventory can guarantee the production for 15 days in some downstream plants, longer for near one month. The logistics will gradually suspend from this weekend affected by Spring Festival holiday. Spandex market witnesses better supply and demand at the beginning of 2023. The operating rate of spandex plants increases but some plants still control the run rate. The price of MMDI and PTMEG bottoms out. Many market players are optimistic about the sales and price of spandex after the Lunar New Year’s holiday. Supported by the factors such as supply, cost and demand, price of spandex may be hard to reduce but easy to increase before and after the Lunar New Year’s holiday. However, cautious mindset is held toward the spandex market at the end of Q1 2023. After the capacity expansion peak in 2022-2023, spandex market will see apparent oversupply. The increase of demand may be hard to chase up that of supply, which will restrict the rebounding range of spandex price. |

http://www.ccfgroup.com/newscenter/newsview.php?Class_ID=D00000&Info_ID=2023011230066

January 12, 2023

Univar gains amid report about interest from PE firms Apollo, Platinum

Jan. 11, 2023 3:17 PM ETUnivar Solutions Inc. (UNVR)APO, BNTGFBy: Joshua Fineman, SA News Editor1 Comment

Univar Solutions Inc. (NYSE:UNVR) rose 3.4% amid a report that private equity firms including Apollo Global (APO) and Platinum Equity may be interested in a takeover of the US chemical distributor.

The PE firms are evaluating offers and potential buyers are holding discussions with Univar (UNVR) this month, according to traders, who cited a Bloomberg report. The talks are early and Univar hasn’t decided if it will sell itself.

The report comes after Brenntag (OTCPK:BNTGF) last Monday said it ended talks to acquire rival chemical distributor Univar (UNVR).

Univar indicated last Monday that it will continue talks relating to other indications of interest that have been received with respect to a potential transaction. Univar (UNVR) is said to have received takeover interest from multiple strategic buyers valuing the company at around $40/share, according to a Street Insider report at the time.

In late November activist Engine Capital, which disclosed it had a ~1% stake in Univar, said the company should start a competitive sales process that invites additional parties to bid for Univar besides Brenntag.

Engine Capital highlighted a letter it sent to Univar’s board in October and estimated that Univar (UNVR) may be worth $38-$44/share in a takeover.

January 11, 2023

BASF breaks ground on MDI capacity expansion project at Geismar site

January 11, 2023 11:46 ET | Source: BASF Corporation

GEISMAR, La., Jan. 11, 2023 (GLOBE NEWSWIRE) — BASF has broken ground on the third and final phase of the methylene diphenyl diisocyanate (MDI) expansion project at its Verbund site in Geismar, Louisiana, announced in July 2022. The company will increase production capacity to approximately 600,000 metric tons per year by the middle of the decade to support the ongoing growth of its North American MDI customers.

The investment for this final expansion phase, which takes place from 2022 to 2025, amounts to $780 million. Including the first and second phases, the investment volume totals around $1 billion, making the MDI expansion project BASF’s largest wholly owned investment in North America.

“BASF already ranks among the largest and most forward-looking chemical companies in the United States,” said Michael Heinz, Chairman and Chief Executive Officer, BASF Corporation. “Through this investment, we demonstrate our commitment to meeting the needs of our customers while strengthening our foundation for continued growth in the important U.S. market.”

BASF welcomed Clay Schexnayder, Speaker of the House for the Louisiana State Legislature for a ceremonial ‘tilling-of-the soil’ to officially mark the groundbreaking of the final phase of the expansion.

“We are committed to continuing the success story together with our North American MDI customers,” said Stefan Doerr, Senior Vice President, Monomers North America. “BASF is investing to support our customers in various industries with significant growth potential in MDI applications, including transportation, automotive, footwear and furniture.”

Kicked off in 2018, the expansion project follows a staggered approach. First, a new MDI synthesis unit was put in operation in October of 2020. The second phase, which started operations in 2021, expanded several existing upstream units. The third and final phase will add new upstream units and a splitter. Leveraging state-of-the-art technology, the expansion will showcase the highest safety standards combined with advanced digitalization in its operations.

January 11, 2023

‘Surge finally over,’ US imports back near pre-pandemic levels

Descartes: December 2022 imports just 1.3% above December 2019 imports

· Tuesday, January 10, 2023

Listen to this article

0:00 / 3:50BeyondWords

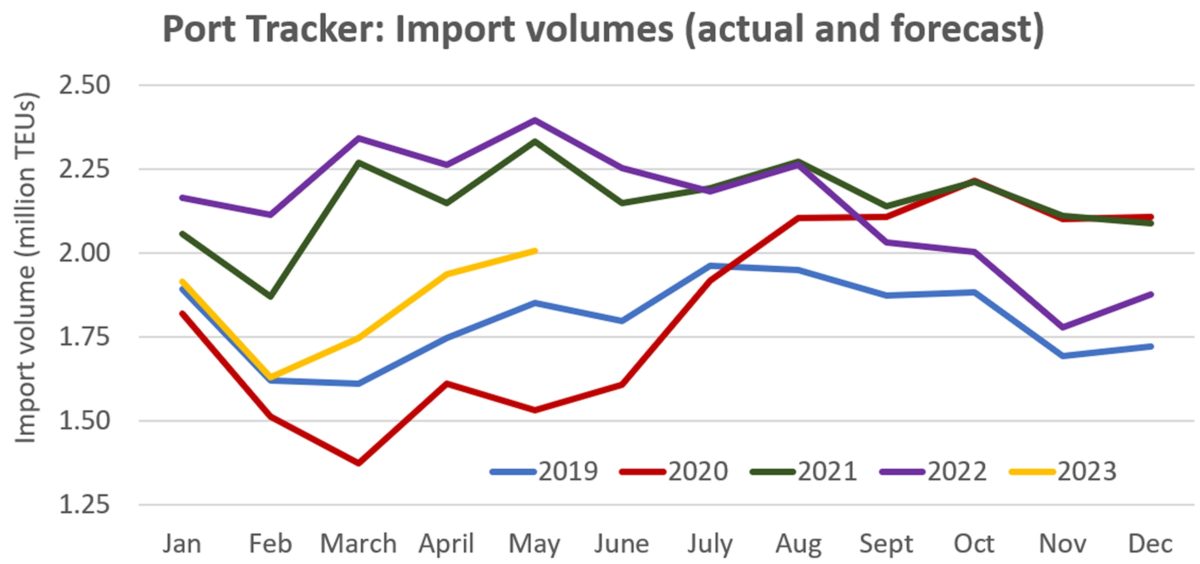

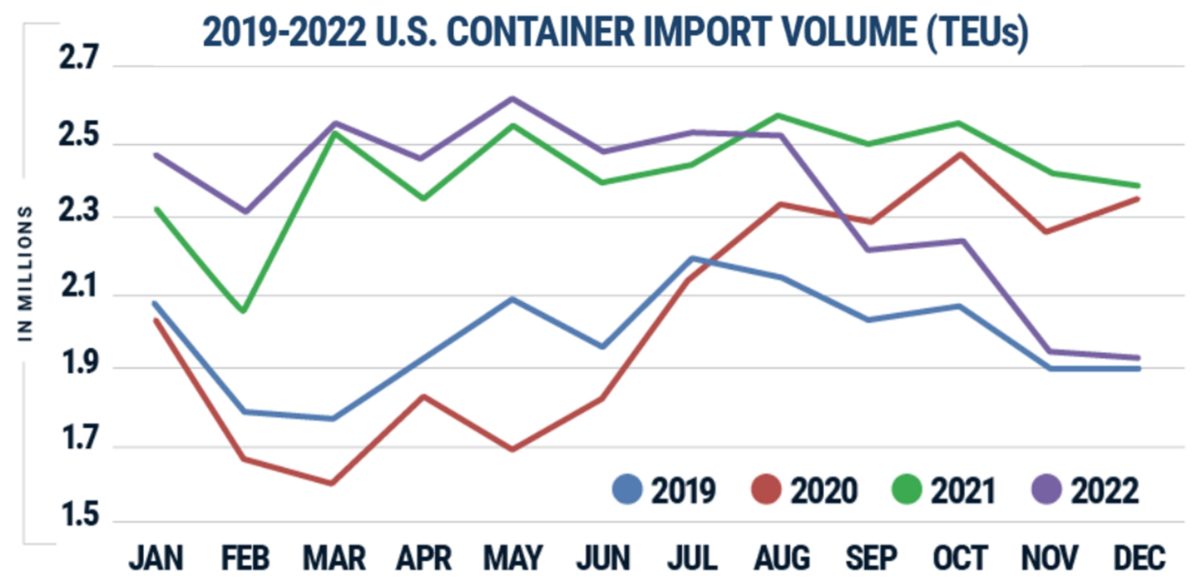

The “new normal” is looking a lot like the old normal as U.S. imports continue to fall. Volumes began declining sharply in September and were already close to 2019 levels by the end of last year. They’re expected to pull even with pre-COVID numbers this month and next.

The “pandemic-driven surge [is] finally over,” said the National Retail Federation (NRF).

The NRF publishes the monthly Port Tracker report together with Hackett Associates. “Import patterns appear to be returning to what was normal prior to 2020,” said Hackett Associates founder Ben Hackett.

Port Tracker covers 12 U.S. ports. While final counts are not in yet, it estimated the ports it covers handled 1.88 million twenty-foot equivalent units in December, down 10.1% year on year.

Port Tracker forecasts that import volumes in January and February will be roughly even with pre-COVID levels then will bounce back above them again in March-May.

Another data provider, Descartes, reported imports for all U.S. ports totaled 1,929,032 TEUs in December, just 1.3% higher than imports in December 2019, pre-COVID.

Last month’s imports were down 19.3% year on year and down 1.3% versus November, according to Descartes.

A FreightWaves SONAR dataset on U.S. Customs import shipments likewise shows a reversion to pre-pandemic conditions. Shipments are now back to 2019 levels.

Not all back to normal

Countrywide volumes are close to pre-boom levels, but there are still some big differences.

Ocean schedules have improved, but delays remain higher than they used to be. In the first week of January, the Flexport Ocean Timeliness Indicator for the Asia-U.S. route was still 25% higher than three years ago.

The coastal mix is also much different. Ports on the East and Gulf coasts continue to handle significantly higher volumes than before the pandemic. Volumes on the West Coast are much lower than they used to be.

A new West Coast dockworker labor contract has still not been signed, over seven months after the last one expired.

“The continuing labor uncertainty could be a significant reason why import volumes are not shifting back to major California ports despite their improving situation,” said Chris Jones, executive vice president of industry and services at Descartes.

The COVID-19 situation in China presents another ongoing complication for supply chains. “COVID infection is widespread and given that the Chinese population has little to no immunity, the impact of COVID on manufacturing supply chains could continue for quite some time,” noted Jones.

There could also be another inventory effect ahead — this time in the opposite direction. In 2022, importers brought in too much; at some point in 2023, they may find they have too little.

“People … will see that underlying consumer demand is actually relatively healthy and all of a sudden, they’ll become concerned that their inventories are a bit on the low end and we’ll possibly see a bounce-back,” said Hapag-Lloyd CEO Rolf Habben Jansen last year.

Hackett predicted, “As inflation eases and consumer spending returns, we project that growth will slowly return going into the second half of the year.”

January 10, 2023

Mattress Firm pulls IPO plans amid recessionary fears

Jan. 10, 2023 4:20 PM ETSteinhoff International Holdings N.V. (STHHF)WMT, AMZN, TPX, SNBR, SSB, W, PRPL, MFRMBy: Val Kennedy, SA News Editor

Mattress Firm (MFRM) has pulled plans for an initial public offering as retailers brace for a possible recession later this year.

The mattress retailer first filed for the IPO in January 2022, indicating it was looking to raise $100M, a number that was likely a placeholder and subject to change. Shares were expected to trade on NYSE under the symbol MFRM.

The IPO would have marked a return to the public markets for Mattress Firm, which was taken private by Steinhoff International (OTC:STHHF) in 2016 for $3.8B. The retailer ended up filing for bankruptcy in 2018, but emerged a month later. It shuttered around 700 stores as part of its reorganization.

As of the end of September 2021, Mattress Firm still had 2,353 retail stores, according to its IPO filing. The company also sells mattresses and bedding through its e-commerce sites mattressfirm.com and sleep.com. In addition to reselling brands made by mattress makers such as Tempur Sealy (TPX) and Serta Simmons (SSB), Mattress Firm also sells products under its private labels, Tulo and Sleepy’s.

Mattress Firm has been facing increased competition from mattress sellers Casper, Purple (PRPL) and Sleep Number (SNBR), along with online furniture retailers such as Wayfair (W), Amazon (AMZN) and Walmart (WMT). Mattress maker and retailer Casper was taken private by Durational Capital in January of last year.

On Tuesday, Wedbush said that it sees Mattress Firm as an acquisition candidate in the wake of the IPO withdrawal, with Tempur Sealy as a possible bidder.