Current Affairs

September 12, 2023

Pretty Obvious

Locked Items, Self-Checkouts & Disappearing Staff: Rising Theft And Slowing Sales Eat Away At Retail

by Tyler Durden

Tuesday, Sep 12, 2023 – 07:45 PM

Across the retail industry, a trend is emerging: less employees, more self-checkouts and more items locked up behind safety doors.

The cause? Slowing sales and rising theft are eating into profits, according to the Wall Street Journal, who wrote this week that the “countermeasures” being used by retailers to fight theft and other shrink could make in-person shopping “even more miserable than it already is”.

In addition to having to deal with normalized looting across the country thanks to Democratic DAs, retailers also are dealing with “the steepest annual wage growth since the 1980s,” the report says. Average wages in the sector have now risen to about $20.54 per hour, the report says.

Remember that the next time some cashier wearing Airpods sighs when you ask them to take a stick of deodorant out of its alarmed hiding spot.

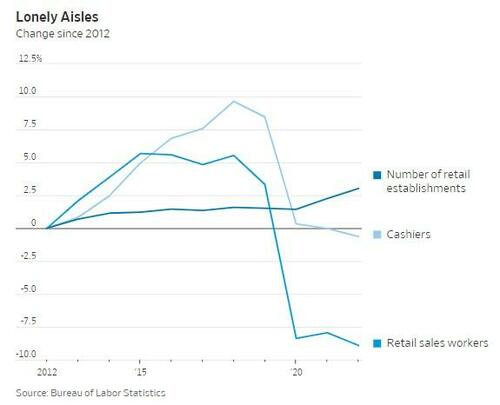

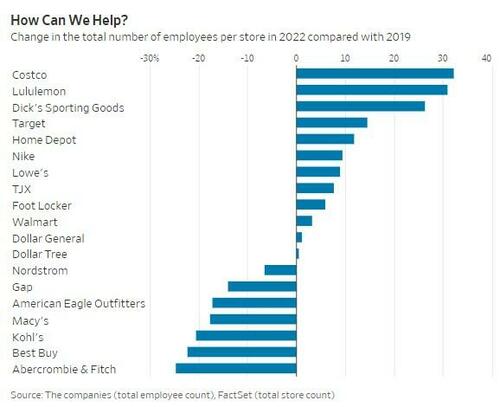

And so as a result, retailers have cut head cut and have not returned to their pre-pandemic staffing levels. Retail sales workers fell 12% from 2019 to 2022 and stores like Macy’s and Kohl’s have lost as many as 20% of their staff. Gap and Best Buy cut their staff by 25% and 22%, respectively. Only a handful of companies like Lululemon, Nike, T.J. Maxx and Costco have raised their employee headcounts.

Lorraine Hutchinson, retail-sector equity analyst at Bank of America says that the employees that are in stores now spend their time filling online orders.

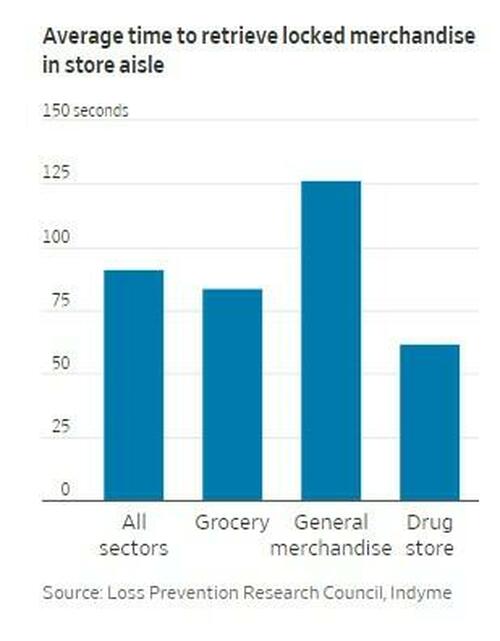

Shrink remains a key concern with retailers like Ulta now locking up 50% of its fragrances at stores. The practice has become so widespread that it is now a talking point on almost all retailer earnings calls.

David Bassuk, global leader of the retail practice at AlixPartners, commented: “Unfortunately, we’re facing a situation where shrink is a CEO topic. It used to be a store-manager topic.”

Neil Saunders, managing director of research firm GlobalData confirmed that retailers like Dollar General are seeing poorer performance due to a lower in-store employee footprint. He said that Macy’s poor results were due to an “incredibly sloppy attitude to retail” and called their staffing a “complete breakdown”. Dollar General has said they need to “further elevate the in-store experience and better serve its customers.”

Best Buy has been a positive example of the “new” retail: despite employing 35,000 fewer individuals in 2022 compared to 2019, the company has surpassed Wall Street’s revenue expectations in eight out of the last ten quarters. By emphasizing cross-training, they’ve enabled their workers to perform multiple roles, from customer service to online order processing.

Moreover, in their recent earnings report, Best Buy indicated that automated virtual agents are handling 40% of customer inquiries without human intervention

Buck the trend and increase customer service for better results!

September 12, 2023

Prediction: The End of the Bottom is Near for Chemicals

WTI Breaks Out To New Nov Highs After OPEC Data Shows Huge Supply Shortfall

by Tyler Durden

Tuesday, Sep 12, 2023 – 08:23 AM

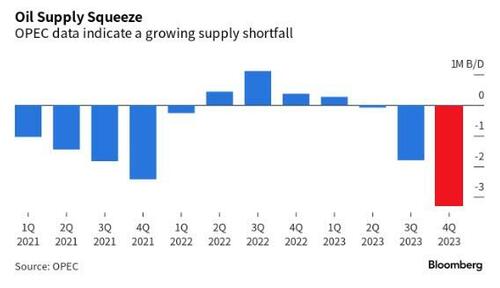

Oil prices had been coiling for a few days ahead of this data and are breaking out now after OPEC reports that global oil markets face a supply shortfall of more than 3 million barrels a day next quarter – potentially the biggest deficit in more than a decade.

If realized, it could be the biggest inventory drawdown since at least 2007, according to a Bloomberg analysis of figures published by OPEC’s Vienna-based secretariat.

OPEC’s 13 members have pumped an average of 27.4 million barrels a day so far this quarter, or roughly 1.8 million less than it believes consumers needed, according to the report.

WTI pushed above $88 on the news, its highest since Nov 2022…

As Bloomberg reports, The kingdom’s hawkish strategy, aided by export reductions from fellow OPEC+ member Russia, threatens to bring renewed inflationary pressures to a fragile global economy.

Diesel prices have surged in Europe, while American airlines are warning passengers to brace for increased costs.

It could even become a political issue for President Biden as he prepares for next year’s reelection campaign, with national gasoline prices nearing the sensitive threshold of $4 a gallon.

Editor’s Note: PS: What happens to inventories when customers expect increases?

September 11, 2023

UAW Strike Update

UAW Begins Negotiations With Detroit Automakers, Admits ‘Things Moving Slowly’ As Deadline Looms

by Tyler Durden

Monday, Sep 11, 2023 – 01:55 PM

Update (1355ET):

After United Auto Workers rejected all three offers from Detroit’s “Big Three” automakers – General Motors, Ford, and Stellantis, the producer of Chrysler – last week, the union said they’re now ready to negotiate.

As quoted by Bloomberg, UAW President Shawn Fain stated, “We are ready to negotiate in Detroit 24/7, just as we have been for the past seven weeks since we gave them our Members Demands.”

Fain continued, “Despite receiving no response for over a month, when the CEOs are ready to make a serious offer, we’ll be there, day or night.”

Bloomberg said UAW officials already met with the automakers on Monday. The union boss said, “Things are moving but they’re moving very slow, and we’ve got a long way to go in four days.”

Thursday is the deadline for a new four-year labor agreement for approximately 146,000 workers. A strike will follow shortly after that if a labor deal is not agreed upon.

Members are preparing for a strike.

* * *

The pro-union Biden administration has been very confident United Auto Workers won’t strike against Detroit’s “Big Three” automakers – General Motors, Ford, and Stellantis, the producer of Chrysler – and a deal will be struck before Thursday. Even though Bank of America Securities warned clients, a “strike is almost guaranteed.”

Earlier this month, Biden was vacationing at his beach house in liberal white-elitest Rehoboth Beach when he said, “I’m not worried about a strike. I don’t think it’s going to happen.”

As the Thursday deadline looms, one which UAW’s current contract with the automakers expires, Deputy Treasury Secretary Wally Adeyemo reaffirmed Biden’s stance that there will be no strike.

Adeyemo told CNBC this morning that UAW leaders and automakers are well-positioned to hammer out a new four-year labor agreement for approximately 146,000 workers before the deadline.

He said both sides want to reach a new labor contract because it’s in their best economic interests, adding, “They’re well positioned to cut this deal, that’s what we expect them to do.”

However, John Murphy, a senior auto analyst at Bank of America Securities, warned clients last week that a strike was “almost guaranteed.”

Murphy expects negotiations will result in a 25-30% increase in labor costs over the next four years with “sizable cash signing bonuses and adjustments to other benefits” once contracts are finalized.

He said the word on the street is “UAW may offer a counter-proposal to the OEM offers shortly” but warned, “We continue to believe a strike is very likely after the Master Agreement expires next Thursday, September 14.”

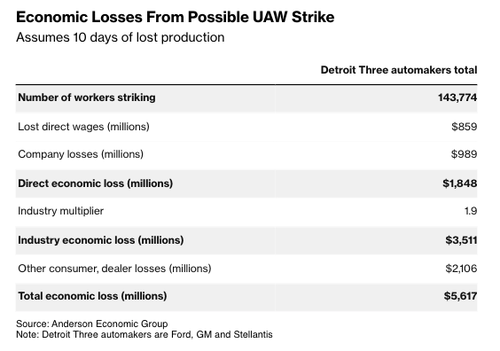

Bloomberg cited new data from economic consultancy Anderson Economic Group that showed just ten days of strikes at General Motors, Ford, and Stellantis factories could reduce US gross domestic product by $5.6 billion and quickly spiral Michigan’s economy into a recession.

“If we were to have a long strike in 2023, the state of Michigan and parts of the Midwest would go into a recession,” said Patrick Anderson, chief executive officer of Anderson Economic.

Anderson said, “When GM workers went on strike in 2019, you saw gross state product drop in Michigan in the fourth quarter, while in the rest of the country it was largely unaffected. That won’t be the case this time if the UAW goes through on its threat to strike all three companies.”

Here’s Anderson Economic’s economic loss forecast for a ten-day strike:

Any such labor action could be bad news for car buyers as it would cause some models to soar in price due to scarcity issues. However, the walkout could send key commodity prices lower, especially hot-rolled steel.

Charlie Chesbrough, senior economist at Cox Automotive, said major automakers have about 58 days’ worth of inventory. He said, “I don’t know that a couple of weeks would have a noticeable impact in the marketplace.”

Chesbrough said it would be a different story if the strike “goes on for a couple of months,” indicating supply chain snarls as ones experienced during Covid could reemerge.

What became evident last week is that the labor contract offers from all three automakers to UAW fell significantly short of the union leader’s demands. UAW President Shawn Fain described GM’s labor contract proposal as “insulting.”

The only issue with unions demanding higher wages, and some even succeeding, such as UPS Teamsters locking in a handsome contract for their delivery drivers, comes when the Federal Reserve is trying to cool inflation. And if unions get what they want, this will make the Fed’s job even harder.

September 5, 2023

Comments on Truck Driver Availability

The perpetual truck driver shortage is not real

Number of trucking carriers has increased 45% since July 2019

Craig Fuller, CEO at FreightWaves

· Tuesday, September 05, 2023

Listen to this article

0:00 / 5:04BeyondWords

The seemingly perpetual marketwide truck driver shortage is not real, nor is it marketwide. While specific fleets can and do have driver shortages — i.e., unseated trucks — the trucking market quickly corrects.

There also are periods of capacity shortages, but those get addressed very quickly by the market.

With no barriers to entry, almost anyone can create a trucking company. That is exactly what has happened over the past four years.

Operating authority for motor carriers of property issued by the Federal Motor Carrier Safety Administration grew by 45% from July 2019 to August 2023, according to FreightWaves SONAR’s latest data, released in partnership with Carrier Details. Truckload demand as measured by the SONAR Outbound Tender Volume Index (OTVI) is only up about 11% during the same period.

The current difficult conditions in trucking are a result of too much capacity chasing too little freight.

Where does the perpetual driver shortage myth come from?

Generally speaking, the driver shortage myth stems from larger trucking companies that find it difficult to recruit drivers into their fleet operations. After all, fleets have to compete for truck drivers with other trucking companies. In addition, some licensed truck drivers go to work in other sectors of the economy, like construction and warehousing. But the fleets also have to compete against the growth of independent operators.

The American Trucking Associations propagates the narrative of the shortage. ATA members consist of midsize and large trucking fleets, which have increasingly become a smaller percentage of the trucking industry’s total capacity.

The ATA’s membership dues are indexed based on company size. For example, a large fleet with $4 billion in revenue will pay a much larger fee than a carrier with $50 million in revenue. Moreover, the ATA is a trade association and lobbying organization, which seeks to influence Congress when it considers legislation that impacts the trucking industry.

As the ATA encourages Congress to pass laws and appropriations that fund employee driver training and recruitment programs — while minimizing regulations that favor larger trucking fleets that employ drivers rather than independent owner-operators — it helps to paint a picture of a perpetual driver shortage.

After all, if Congress realized how fast capacity enters the market from independent operators when there is a capacity crunch, it would mitigate the need for employee driver recruitment and retention entitlement programs.

The FMCSA data tells the story about the growth of the small independent fleet

SONAR, FreightWaves’ proprietary data platform, collects data from a number of sources, including the FMCSA, the regulatory body that oversees the trucking industry. One of the FMCSA’s data sets tracks fleet registrations by the number of trucks that are assigned to a particular fleet.

SONAR breaks down the fleet sizes into cohorts to provide a more accurate reflection of the growth and fragmentation of trucking fleets.

In the SONAR chart below, the white line is the total number of tractors among fleets of one to six trucks; the purple line is the total number of tractors among fleets of seven to 11 trucks; the yellow line is the total number of tractors among fleets of 12 to 19 trucks; the blue line is the total number of tractors among fleets of 20 to 100 trucks; the orange line is the total number of tractors among fleets of 101 to 999 trucks; and the green line is the total number of tractors among fleets of 1,000 trucks and more.

Of the 2.9 million trucks in the market, 1.2 million are in fleets with more than 100 trucks — or just 41%. In 2010, fleets with more than 100 trucks comprised 54% of total trucking capacity.

Midsize and large fleets have problems recruiting new employee drivers, often due to lifestyle issues. Many drivers do not want to be away from home for days or weeks at a time, especially in a forced dispatch operation, which is typical of truck driver fleet operations.

For truck driving entrepreneurs who want to have the autonomy of their own operations, no such challenges exist. After all, if you want to dictate which loads make sense for you, based on destination, time in transit or even commodity, you can do so as an independent trucker with far more control than an employee fleet driver. Therefore, independent owner-operator entrepreneurs are constantly entering the market.

With the barriers to entry for new fleets becoming increasingly less burdensome, the number of smaller fleets in the industry will continue to grow. I broke down this phenomenon last week in an article on the growth of mom-and-pop trucking companies.

A downside to this trend? It is likely that boom and bust cycles in trucking become more pronounced and violent.

But for now, a capacity correction is underway and this is welcome news for everyone in the trucking industry.

August 31, 2023

European Auto Sales

European Auto Sales Rose 17% In July, Marking 12th Consecutive Month Of Gains

by Tyler Durden

Thursday, Aug 31, 2023 – 04:15 AM

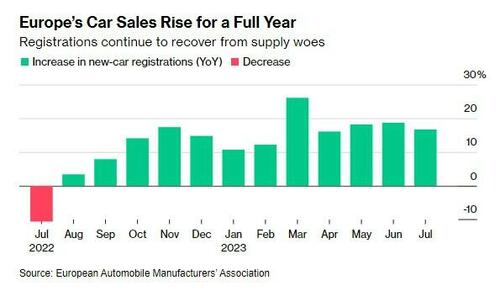

European vehicle sales are going to be on watch heading into the back half of the week after automobile sales in Europe rose for the 12th consecutive month in July, Bloomberg reported this morning.

Germany, France and Spain all saw double digit growth for the month, the report says. In sum, registrations of new cars were up 17% to 1.02 million vehicles, the report says, citing data from the European Automobile Manufacturers’ Association.

Volkswagen sold the most passenger cars in the region with 280,294 registrations, up 19% from a year prior. Buyers in Germany saw the biggest YOY rise, with 48,682 cars sold in July, up 69% from 2022.

Battery electric cars led the charge across Europe, rising 62%, at the same time sales of diesel models fell 9%.

As we have reported, Tesla’s Model Y was the best selling vehicle in Europe in the first half of the year, but manufacturers like Volkswagen AG, Stellantis NV and BMW AG are setting up to challenge the EV maker’s dominance with new model releases in the second half of the year.

Several of these models are expected to debut at next week’s IAA car show in Munich, Bloomberg wrote.

After battling through endless supply chain challenges and dealing with a semiconductor shortage as a result of the pandemic, automakers are finally seeing operations resemble a return to normal in 2023.

However, new challenges for the industry include a worldwide rising cost of living and higher borrowing costs, with Central Banks hiking interest rates far higher than during the pandemic.

https://www.zerohedge.com/markets/european-auto-sales-rise-17-july