Current Affairs

September 28, 2023

Shepherd and Everchem

Shepherd’s Exclusive Partnership with Everchem

As a leading global metal chemistry manufacturer, Shepherd relies on key partnerships to help boost product awareness and sales. Everchem is one such partner, deserving not only recognition but gratitude for its commitment to marketing Shepherd’s BiCAT polyurethane catalyst product line to customers in need of catalysts for polyurethanes, spray foam, coatings and more.

Everchem is an exclusive partner for Shepherd’s BiCAT® polyurethane catalyst product line in United States and Canada. The partnership provides downstream customers with access to the broad range of BiCAT® products, an array of packaging options, closer-to-market customer service, and an unmatched level of expertise within the polyurethane market that only Everchem provides.

At its core, Everchem is a sales, marketing, and technology driven company that operates within the North American marketplace. Its core markets served include urethanes, epoxy, UV curing, and industrial chemical raw materials. Everchem prides itself on providing invaluable market intel and superior service which creates mutual benefit and value to customers and suppliers alike. The company’s lean business model and strong supplier relationships increase its responsiveness to customer needs with lower costs and less bureaucracy than many larger organizations can offer.

The Future of BiCAT Polyurethane Catalysts is Bright

Shepherd is considered a market leader when it comes to current and next-generation polyurethane catalysts. It was the first to develop hydrolytically stable bismuth carboxylate chemistry for use in HFO blowing agents, which reduces VOC’s and improves curing rates amongst other enhancements. This technological breakthrough earned Shepherd the 2016 CPI (The Center for The Polyurethanes Industry) Polyurethane Innovation Award.

Shepherd has experienced healthy growth in the sales of its BiCAT® product line through Everchem since our partnership was announced in September 2019. Through this arrangement, BiCAT® products are finding new markets, new customers, and new applications which only enhance the historically strong Shepherd brand.

Our Shared Philosophy

The mutually shared philosophy upon which Everchem and Shepherd respectively and collectively do business is a strategic difference maker when it comes to serving customers. We work together on a platform of transparency, which has yielded fantastic results for both companies since the inception of the partnership.

Everchem a wonderful steward of the Shepherd brand and our confidence in their capability and reliability is second to none. The future only provides additional opportunity for further strengthening of this relationship between the two companies.

If you’re in the market for BiCAT polyurethane catalysts, we’d love to work with you. Please contact us online or by calling 513-731-1110.

www.shepchem.com/news

September 28, 2023

Trucking Update

Trucking sees ‘green shoot’ in August

But capacity growth in private fleets could slow recovery, ACT says

· Wednesday, September 27, 2023

FreightWaves

Trucking sees ‘green shoot’ in August

4 min

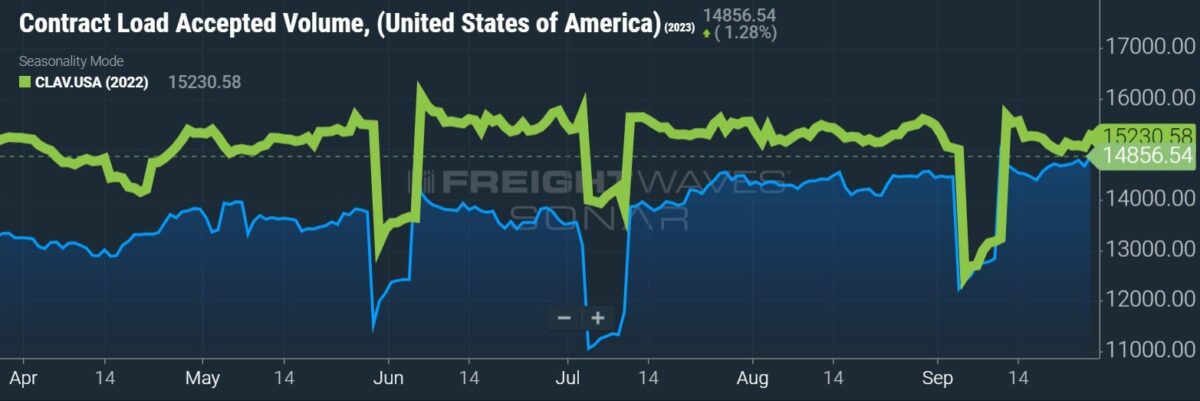

A Wednesday report from ACT Research showed the trucking cycle may be “approaching [a] turning point.” All five components of ACT’s For-Hire Trucking Index showed improvement from a carrier’s perspective during August, with volumes logging a large turnaround.

ACT’s volume index jumped 12.3 percentage points to 54.4 on a seasonally adjusted basis from July to August.

A reading above 50 indicates growth while one below 50 implies contraction. The report was quick to caution that the measure is one of breadth, with a large number of fleets seeing an increase but not necessarily a pronounced one.

“So, we wouldn’t suggest this means the freight downturn is over, but it is a considerable ‘green shoot’ that suggests the retail inventory destock is playing out,” said Tim Denoyer, vice president and senior analyst at ACT.

August produced the highest reading for the volume index since early 2022 and a level well above the mid-30s to mid-40s readings displayed throughout the spring. Inventory levels approaching a better balance and a reduction in import declines to the West Coast were cited as contributors.

“Additionally, consumers remain a surprising economic upside, even in the face of sustained high, if moderating, inflation, and are reverting to more goods spending after the service spending boom coming out of the pandemic,” Denoyer said. “Though, still-high inflation and decreasing savings are headwinds to future consumer spending.”

ACT’s capacity index was in modest contraction territory for a second straight month at 48.9. The data set was down one point seasonally adjusted from July.

Those surveyed included mostly large, for-hire fleets. However, the report noted that Class 8 tractor sales remain near all-time highs, which is indicative of capacity being added by private fleets as well as small carriers buying secondhand equipment from larger fleets.

With better volumes and a modest contraction in capacity, the supply-demand balance index jumped 13.4 points to 55.6 in August on a seasonally adjusted comparison. This was the first reading above 50 in 18 months.

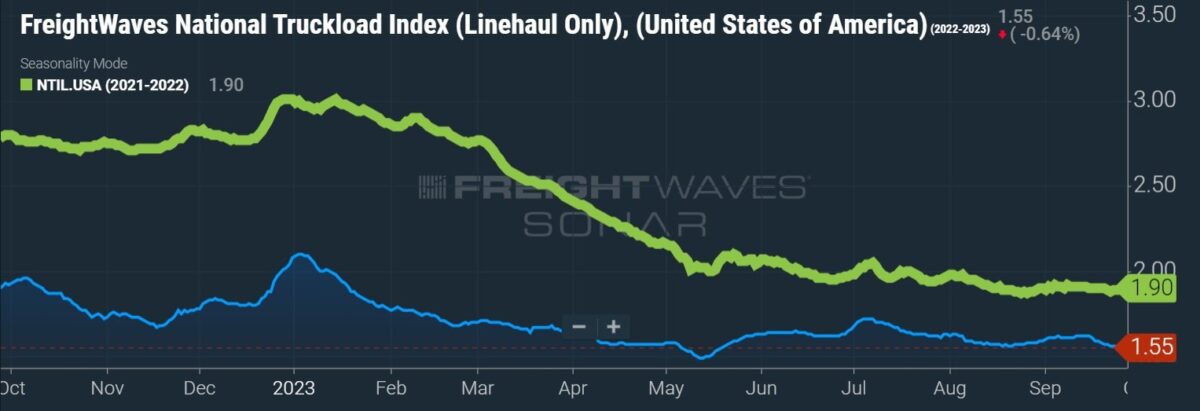

Truck pricing remained under pressure during the month at 39.3. The report noted a “less worse” trend as the index improved 2 points from July and continued to improve from the record low of 30.5 in April. ACT expects a soft pricing environment to linger in the near term.

“Though growth in private fleets may be delaying the recovery in rates, the trucking market appears to be past the nadir, and the improved supply/demand balance this month suggests more less worse results to come,” Denoyer said.

Other findings from the report showed fleet productivity (measured as miles per tractor) increased 6.1 points seasonally adjusted to 53.6 in August. However, 56.4% of survey respondents said they would be buying new equipment in the next three months, which could weigh on the metric. Buying intentions were roughly 7 points below the prior-year level as many of the big, for-hire fleets have largely caught up on their replacement cycles, which were extended during the pandemic.

“We expect fleet ordering intentions to subdue as contract rates are under severe pressure and pent-up demand is fading following capacity constraints the last two years,” Denoyer said.

The driver availability index remained elevated at 59.5 during August. The loosening in the driver labor market was in part credited to spot-market-dependent operators leaving for more stable working conditions at larger fleets.

“Driver availability also remains extraordinarily good for the diverse group of for-hire fleets in our survey,” Denoyer said. “In our view, this probably isn’t enough yet to turn the tide in the spot market, but the market rebalancing is progressing and this should be a good leading indicator of better times ahead.”

September 17, 2023

Advertising and Direct Mail May Take A Hit

IRS Halts Pandemic-Era Small-Business Tax Break Following ‘Flood’ Of Potential Fraud Claims

by Tyler Durden

Sunday, Sep 17, 2023 – 11:40 AM

Authored by Naveen Athrappully via The Epoch Times (emphasis ours),

The Internal Revenue Service (IRS) has announced pausing a small-business tax credit program from the pandemic era for the remainder of the year following worries that ineligible claims are being filed.

The Employee Retention Credit (ERC) was instituted during the COVID-19 pandemic to encourage small businesses to retain their employees on payroll. It offered a refundable tax credit for businesses that paid employees while being shut down due to lockdowns and other restrictions. More than three years later, applications for ERC claims continue to pour in at the agency.

Amid “rising concerns about a flood of improper Employee Retention Credit claims,” the IRS announced an immediate moratorium on the program on Sept. 14 that is valid through “at least the end of the year.”

With the moratorium in effect, it would mean that new claims for ERC would not be processed. However, the agency would continue working on previously submitted ERC claims, it said. Processing times may be longer due to fraud concerns.

The moratorium was ordered by IRS Commissioner Danny Werfel due to worries that third parties or “promoters” were aggressively pressuring ineligible businesses to file for ERC claims. Such third parties can charge hefty fees for services, which can go up to 25 percent of the ERC refund.

Even though promoters advertise that ERC claim-submissions as “risk free,” businesses filing such claims face “significant risks” as the agency increases its audit and criminal investigation into the matter.

According to the IRS, any business that improperly files for ERC claims must pay back the received credit together with potential interest and penalties.

“A business or tax-exempt group could find itself in a much worse financial position if it has to pay back the credit than if the credit was never claimed in the first place,” the IRS stated.

The agency has received around 3.6 million ERC claims over the course of the program, which is roughly a fourth of the total number of U.S. businesses that file tax returns annually.

The IRS has already referred thousands of ERC claims for audit. Hundreds of claims have been referred to the IRS’s Criminal Investigation division which is “actively working to identify fraud and promoters of fraudulent claims for potential referral for prosecution to the Justice Department.”

As of July 31, the division has initiated 252 investigations related to potential ERC claim fraud worth over $2.8 billion.

Out of these 252 cases, 15 have resulted in federal charges. And among the federally charged cases, six have ended in convictions and four have reached the sentencing phase. The average sentencing is 21 months.

“The IRS is increasingly alarmed about honest small-business owners being scammed by unscrupulous actors, and we could no longer tolerate growing evidence of questionable claims pouring in,” Mr. Werfel said.

“The further we get from the pandemic, the further we see the good intentions of this important program abused. The continued aggressive marketing of these schemes is harming well-meaning businesses and delaying the payment of legitimate claims, which makes it harder to run the rest of the tax system. This harms all taxpayers, not just ERC applicants.”

Tax Credits and Fraud

When the program was initially introduced during the pandemic, the tax credit offered to businesses was 50 percent of a qualified employee’s wages, limited to $10,000 per year.

As such, a qualifying business could receive a credit of up to $5,000 per employee per annum. The credit was later updated to 70 percent of wages, limited to $10,000 in wages per quarter.

To qualify for ERC, a business should have shut down due to a government-imposed restriction during 2020 or during the first three quarters of 2021. Businesses that experienced a decline in gross receipts during this period may also qualify. These employers must have paid wages to their employees during the period to claim ERC.

Like the Sept. 14 warning, the IRS had issued a similar alert about ERC fraud back in March. At the time, acting IRS Commissioner Doug O’Donnell advised businesses that “if the tax professional they’re using raises questions about the accuracy of the Employee Retention Credit claim, people should listen to their advice.”

“People need to think twice before claiming this,” he said.

Despite ERC being only applicable to businesses that were shut down or saw a steep decline in revenue during the pandemic, fraudsters entice business owners by claiming that most businesses qualify for the credit.

During an interview an with The Washington Post, Laurel Blatchford, a Treasury Department official, said that the extensive ERC fraud should prompt Congress to consider new legislation to tackle the issue.

An IRS spokesperson said that the agency has paid over $230 billion in ERC claims, which far exceeds the original congressional estimate for the program.

The IRS advised businesses who have not yet filed for their ERC claim to consider reviewing the guidelines and wait to file for the credit.

“The IRS believes many of the applications currently filed are likely ineligible, and tax professionals note anecdotally that they are seeing instances where 95 percent or more of claims coming in recent months are ineligible as promoters continue to aggressively push people to apply regardless of the rules.” the agency said.

September 17, 2023

Mark Cuban Cost Plus Pharmacy

CVS And Cigna Charge $6,000 For $55 Generics

by Tyler Durden

Thursday, Sep 14, 2023 – 10:20 AM

By Mish Shedlock of Mishtalk

Health insurers dramatically mark up prices of generics and pharmacies are in on the scheme.

Generic Drugs Should Be Cheap But Sometimes They Aren’t

The Wall Street Journal reports Generic Drugs Should Be Cheap, but Insurers Are Charging Thousands of Dollars for Them

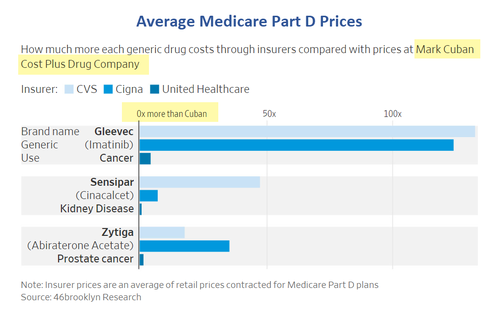

The cancer drug Gleevec went generic in 2016 and can be bought today for as little as $55 a month. But many patients’ insurance plans are paying more than 100 times that.

CVS Health and Cigna can charge $6,600 a month or more for Gleevec prescriptions, a Wall Street Journal analysis of pricing data found. They are able to do that because they set the prices with pharmacies, which they sometimes own.

Across a selection of these so-called specialty generic drugs, Cigna and CVS’s prices were at least 24 times higher on average than roughly what the medicines’ manufacturers charge, the Journal found.

The prices at UnitedHealth Group, which also owns a large health insurer, were 3.5 times as much, according to the analysis of data compiled by 46brooklyn Research, a nonprofit drug-pricing analytics group.

Price Gap

- Cigna’s prices were 27.4 times higher than Cuban’s on average for 19 generic drugs.

- CVS’s prices were 24.2 times higher on average for 17 generic drugs.

- UnitedHealth’s prices were 3.5 times higher than Cuban’s on average for 19 generic drugs.

- Cigna can charge roughly $6,610 a month for Gleevec, the Journal’s analysis found. CVS Health can charge more than $7,000 a month. United Health can charge $218.

- A prescription for generic Tecfidera, a multiple-sclerosis therapy, costs $54 a month through the Cuban pharmacy, compared with nearly $1,215 through UnitedHealth. (Cigna and CVS didn’t submit prices for the drug to Medicare.)

- A monthly prescription for prostate-cancer drug Zytiga costs about $118 on Cuban’s website, compared with $4,195 through Cigna, $2,056 through CVS and $205 through UnitedHealth.

Kudos to Mark Cuban for Increasing Competition

On August 22, I wrote Kudos to Mark Cuban for Lower Priced Drugs and Increasing Health Care Competition

Big Win For Consumers

Fortune called it a big win for Cuban. I suggest it’s a big win for everyone.

It also strikes at the heart of precisely what is wrong with Medicare for all and single payer setups. When government picks up the entire tab, there is no incentive for consumers to shop around for better deals.

Those without health care coverage and those on high deductible plans are the biggest winners.

Some of the savings on CostPlus are amazing.

https://www.zerohedge.com/medical/cvs-and-cigna-charge-6000-55-generics

September 12, 2023

Pretty Obvious

Locked Items, Self-Checkouts & Disappearing Staff: Rising Theft And Slowing Sales Eat Away At Retail

by Tyler Durden

Tuesday, Sep 12, 2023 – 07:45 PM

Across the retail industry, a trend is emerging: less employees, more self-checkouts and more items locked up behind safety doors.

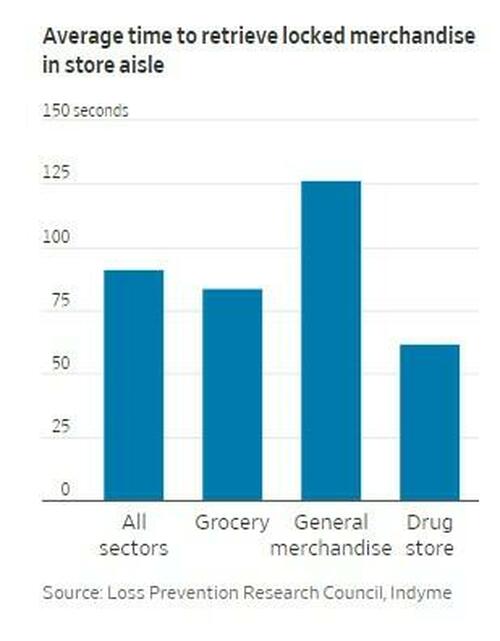

The cause? Slowing sales and rising theft are eating into profits, according to the Wall Street Journal, who wrote this week that the “countermeasures” being used by retailers to fight theft and other shrink could make in-person shopping “even more miserable than it already is”.

In addition to having to deal with normalized looting across the country thanks to Democratic DAs, retailers also are dealing with “the steepest annual wage growth since the 1980s,” the report says. Average wages in the sector have now risen to about $20.54 per hour, the report says.

Remember that the next time some cashier wearing Airpods sighs when you ask them to take a stick of deodorant out of its alarmed hiding spot.

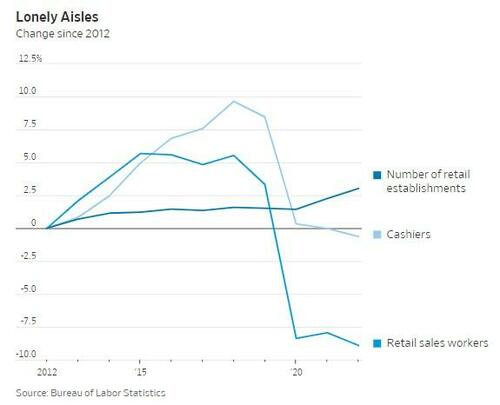

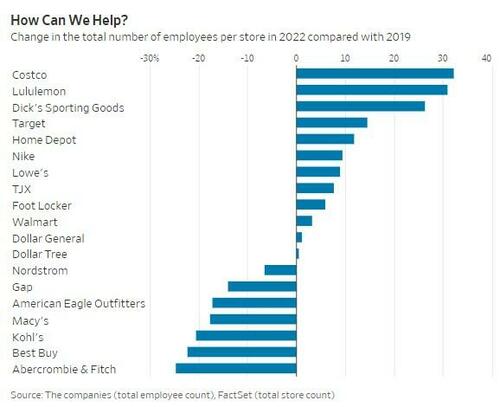

And so as a result, retailers have cut head cut and have not returned to their pre-pandemic staffing levels. Retail sales workers fell 12% from 2019 to 2022 and stores like Macy’s and Kohl’s have lost as many as 20% of their staff. Gap and Best Buy cut their staff by 25% and 22%, respectively. Only a handful of companies like Lululemon, Nike, T.J. Maxx and Costco have raised their employee headcounts.

Lorraine Hutchinson, retail-sector equity analyst at Bank of America says that the employees that are in stores now spend their time filling online orders.

Shrink remains a key concern with retailers like Ulta now locking up 50% of its fragrances at stores. The practice has become so widespread that it is now a talking point on almost all retailer earnings calls.

David Bassuk, global leader of the retail practice at AlixPartners, commented: “Unfortunately, we’re facing a situation where shrink is a CEO topic. It used to be a store-manager topic.”

Neil Saunders, managing director of research firm GlobalData confirmed that retailers like Dollar General are seeing poorer performance due to a lower in-store employee footprint. He said that Macy’s poor results were due to an “incredibly sloppy attitude to retail” and called their staffing a “complete breakdown”. Dollar General has said they need to “further elevate the in-store experience and better serve its customers.”

Best Buy has been a positive example of the “new” retail: despite employing 35,000 fewer individuals in 2022 compared to 2019, the company has surpassed Wall Street’s revenue expectations in eight out of the last ten quarters. By emphasizing cross-training, they’ve enabled their workers to perform multiple roles, from customer service to online order processing.

Moreover, in their recent earnings report, Best Buy indicated that automated virtual agents are handling 40% of customer inquiries without human intervention

Buck the trend and increase customer service for better results!