Current Affairs

August 23, 2023

New Home Sales

US New Home Sales Soar To 17-Month Highs In July As Mortgage Rates Spike

by Tyler Durden

Wednesday, Aug 23, 2023 – 10:08 AM

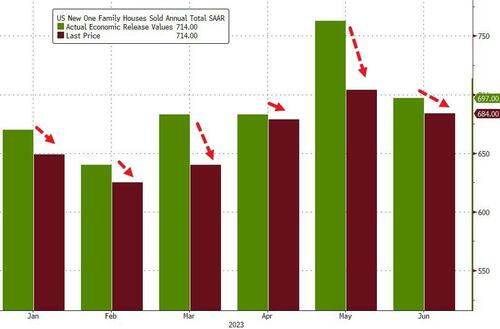

After the disappointing (but not unexpected) decline in existing home sales, new home sales – of course – saw a big upward surprise 4.4% MoM surge in sales, leaving year-over-year sales up an astonishing 31.5%…

Source: Bloomberg

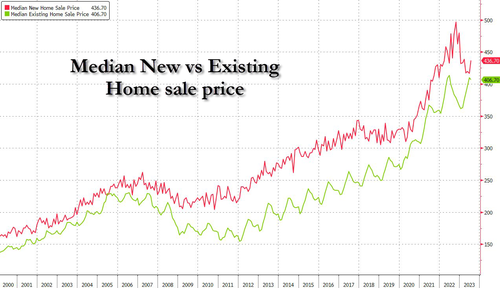

The divergence between new and existing home sales continues to gape wider…

Source: Bloomberg

As a reminder, we have seen huge downward revisions to new home sales figures this year…

Source: Bloomberg

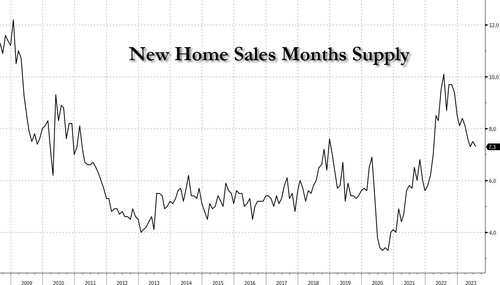

Supply continues to shrink…

Source: Bloomberg

…which helped push median new home sales prices back up in July – even as mortgage rates began to spike…

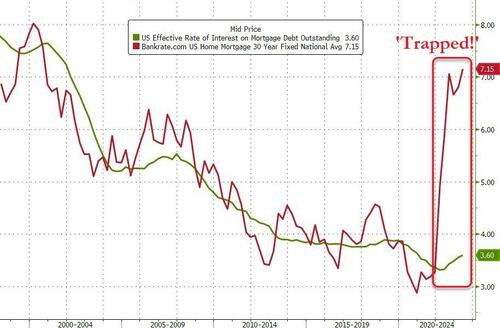

Finally, we note the dramatic gap between the current 30Y mortgage rate and the effective rates that borrowers are currently paying on their home loans…

Source: Bloomberg

The gap hasn’t been this wide since the early 1980s – which helps explain why inventories of existing homes for sale are so low… and thus ‘new homes’, subsidized by homebuilders, is the only option for many.

That’s quite subsidy…

Are home-builder stocks starting to catch on?

But how long can homebuilders continue bleeding profitability to fill that gap?

August 20, 2023

U.S. Housing Starts

August 20, 2023

July Busier than Expected

Takeaways from State of Freight: A surprising volume increase in July

Also in the discussion with FreightWaves CEO Fuller: Capacity hanging in there, contract rates stickier than expected

· Thursday, August 17, 2023

Listen to this article

0:00 / 6:56BeyondWords

With the doors open at FreightWaves headquarters in Chattanooga, Tennessee, to outside visitors who wanted to witness in person the August State of Freight webinar with CEO and founder Craig Fuller — the first time for that — a market Fuller called the most “opaque” he had ever witnessed was the focus Thursday.

July was a month in which a trucking company that had been around for almost 100 years imploded. But the collapse of Yellow, unlike its role in the July webinar, was a relatively minor part of this month’s discussion. (July’s State of Freight webinar also featured extensive discussion about a possible strike at UPS (NYSE: UPS), which did not occur).

Instead, the August chat between Fuller and FreightWaves Director of Market Intelligence Zach Strickland, sponsored by Prologis (NYSE: PLD), kicked off by focusing on some bullish data that came at an odd time of the year.

It was a hot July for more than the weather …

Freight volumes generally decline or are flat in July, Fuller said. “We’ve got this anomalous environment with the tender volumes,” he said, citing the Outbound Tender Volume Index in SONAR. And outside of July 2020, which was another anomaly as the economy climbed back from the depths of the pandemic, OTVI never increases in July. But it did this year.

“If you go back historically, July is a pretty soft market,” Fuller said. He cited as reasons some usual factors — people take vacation around July Fourth — but others that might be less obvious, like the fact that July is a time when auto manufacturers close down some manufacturing lines as they retool for a new model year. Back-to-school merchandise, Fuller said, “has already moved into the distribution centers, so it is really a month where most people take off.”

But OTVI did not react normally this year, Fuller said, “and it’s telling us something is different about this freight economy.” OTVI exited June at 10,670.78; it finished up July at 11,211.4.

One possible reason for the recent strength in OTVI: the impact of federal infrastructure spending making its way into the economy more than a year after the Biden administration’s legislation was signed. “It takes awhile for governments to allocate these funds,” Fuller said. “I think what we’re seeing is the very early stages of some of that money moving through.”

But carriers are not benefiting from rising volumes

The flip side of OTVI is the Outbound Tender Reject Index, which measures freight tenders offered by shippers or brokers that are rejected as they make their way through routing guides. At its tightest, OTRI exceeded 28% on several days in late 2020 and early 2021. At its lowest, it sank to around 2.5% in May. More recently, it was standing at 3.5% to 3.6%.

The increase in OTVI while OTRI lingers at low levels, Fuller said, due to “the amount of capacity that was added during the COVID economy,” a figure he put at 25%. “That means you have a lot of excess capacity that we have to burn through. That needs to happen.”

And it is occuring, Fuller said, citing comments from industry executives who have seen companies enter bankruptcy. “But the problem is the market simply cannot correct fast enough to give anyone any sense of promise about the second half,” he added.

Fuller looked back on the weak freight market of 2019 that was highlighted by the collapse of New England Motor Freight in February 2019 and Celadon at the end of the year. He described those shutdowns as “bookends” to that freight market. And if history repeats itself, Fuller said, the closure of less-than-truckload carrier Yellow might be “the start of the great purge.”

The great inventory purge may be over

Strickland said the inventory situation that is impacting freight markets is one in which “we’re still adjusting to this world after COVID.” That period was marked by “this bubble where everybody went out and bought a bunch of stuff.” But that was followed by “this narrative about inventory reduction, Target and Walmart; they all had to get their inventories under control.” Data is showing that inventories have drawn at a rate faster than anytime since 2016, Strickland said.

Fuller said planning in the supply chain often goes out as much as a year, which means that beginning around May and June 2022, freight markets were signaling a significant downturn in demand. Inventories were “probably carried longer than retailers would have normally.” But if that planning signaled inventory purge starting in June 2022, “it means we’ve gone through a period of at least 12 months where they’ve liquidated inventories, and it’s quite possible that the market is now catching up to that reality.” That could be a factor in the rise in OTVI, Fuller and Strickland agreed.

Rates probably won’t go lower, but they’re not rising either

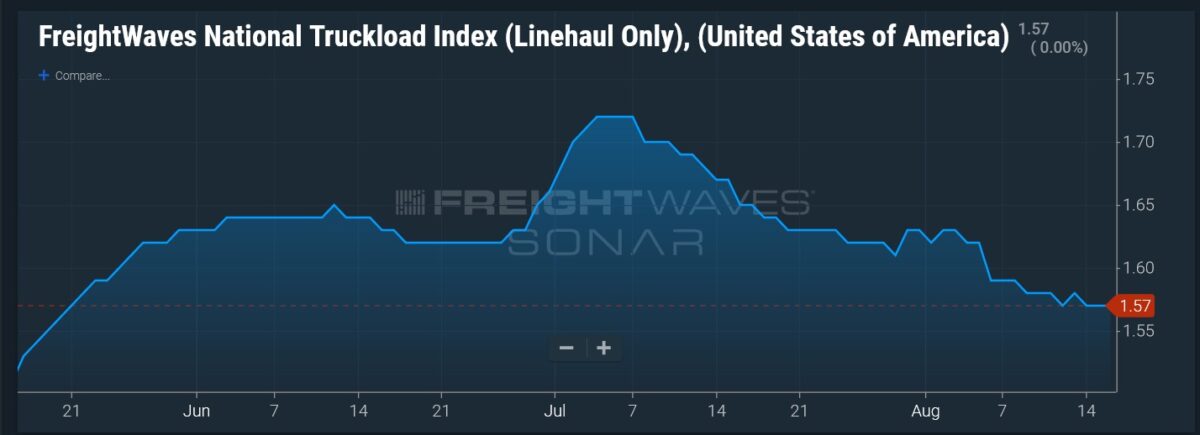

Trucking rates are measured in SONAR through several indices, but the National Truckload Index (Linehaul Only) is considered the most significant because it does not include fuel costs. The NTIL.USA, for the entire country, has risen and fallen between $1.50- and $1.75-per-mile rates in the past three months.

“I think what it is communicating is that there is a bottom in the market and rates will not go much lower,” Fuller said. Carriers have made a “rational decision that if they lower rates any further, they cannot survive. The market is communicating that this is the low end of the rate target.”

Contract rates are not falling as rapidly as might be expected, Fuller said. “And I think what’s happening is that a lot of carriers have rationalized that they don’t want to lower their rates in their RFP too much,” he said, even though as a result, freight is moving into the spot market. “I think the fear is that if they lock in low contract rates, they’re stuck with them.”

Fuller described the whole picture as “the most opaque market I’ve ever seen.”

Container rates unlikely to ever get back to pandemic levels

The Freightos Baltic Index for China to the North American west coast, FBXD.CNAW in SONAR, hit a peak in September 2021 at about 20,586. More recently, it has fallen to about 1,815.

Similar to how Fuller saw the current rise in OTVI linked to U.S. government infrastructure spending, that wild rise in ocean freight rates was also tied to COVID-related stimulus, he said.

But Fuller added that “nearshoring,” the gradual process to move manufacturing away from China and back to North America, is also playing a role in his conclusion that the global economy is not likely to ever return to those sorts of maritime rates. Short of a major military conflict, Fuller said, “I can’t see a scenario where our container rates get to the levels where it was during COVID.”

August 15, 2023

Nearshoring to Benefit Mexico

- Research

- Jun 21, 2023

Mexico Is Poised to Ride the Nearshoring Wave

Closer economic ties to the U.S. could boost GDP and investment as manufacturing exports increase.

The world economy is realigning, with trade and supply chains becoming less decentralized and less deeply interconnected as globalization slows, or even reverses, in a multipolar world.

Mexico, in particular, could be a major beneficiary of this shift to “slowbalization.” Among other reasons, the U.S. is likely to look to allies that are geographically close and politically aligned as trade tensions, supply-chain difficulties and geopolitical concerns push the U.S. further from China.

A key step in this disengagement process is nearshoring, in which U.S. manufacturing companies move production closer to their bases and consumers in the U.S. and away from Asia. Along with its obvious geographical advantages, Mexico offers a large, low-cost labor force and free-trade agreements with the U.S. and Europe.

As U.S. companies increasingly look to their southern neighbor to bolster their supply and value chains, it is likely to boost Mexico’s GDP growth as investment surges, providing new opportunities for companies and investors alike.

“If U.S. manufacturing is to be less dependent on China, we think the path will be via Mexico,” says Morgan Stanley Research equity analyst Nikolaj Lippmann. “Nearshoring is expected to be a long and sustained race that could help build new ecosystems in Mexico’s existing manufacturing hubs.”

Manufacturing Leads Mexico’s Economic Growth

Nearshoring has the potential to boost the growth of Mexican manufacturing exports to the U.S., from $455 billion today to an estimated $609 billion in the next five years.

Manufacturing exports currently represent about 40% of Mexico’s $1.3 trillion economy. This estimated surge, representing more than 10% of GDP, is made up of:

- $94 billion in gains in well-established sectors such as electronics and automotive

- $38 billion from sectors that have benefited from free trade via the United States-Mexico-Canada Agreement, or USMCA

- $22 billion from a second wave of nearshoring growth driven by increased manufacture of IT hardware and new opportunities related to the electric vehicle supply chain and other clean technologies.

Meanwhile, new investment driven by nearshoring could reach about $46 billion in the next five years, helping boost Mexico’s annual GDP growth to around 3% in 2025 to 2027, from an estimated 1.9% in 2022. Recent investments announcements, including a decision by the leading U.S. electric car maker to open a $5 billion plant in Monterrey, highlight the growing nearshoring trend.

But potential hurdles to nearshoring-driven growth remain. While Mexico is well-positioned to tap into the nearshoring opportunity in terms of wages, commodity costs and tax rates, it still faces issues with access to skilled labor, environmental regulation, quality of infrastructure and intellectual property rights, according to a 2022 Morgan Stanley survey of global companies.

Energy infrastructure, in particular, remains a key potential limiting factor. The country has underinvested in the electricity sector and needs to improve grid capacity. Mexico would need roughly $40 billion in incremental spending to build enough generation capacity to power expansion from nearshoring-driven.

“Nearshoring will happen over time, not overnight,” says Fernando D. Sedano, Morgan Stanley’s Latin America Economist.

How to Invest

As Mexico’s GDP and manufacturing grow, so too should corporate profits, especially in the financials, industrials and consumer sectors. In fact, during periods of above-average GDP growth, Mexican equities have tended to outperform in terms of valuation, profitability and operating performance.

Financials, Real Estate, and Consumer Discretionary Names Are More Exposed to the Domestic Model

Chart

Additionally, stocks in industrial real estate, transportation and logistics, metals and cement could benefit from the realignment of supply chains.

The nearshoring trend has already driven a rerating of Mexican stocks, and strategists see further upside for domestic companies in the next five years as the second wave of nearshoring growth gathers momentum.

“A boost in GDP growth would be transformative for domestic stocks, especially in the regions exposed to nearshoring,” says Sedano.

https://www.morganstanley.com/ideas/mexico-nearshoring-gdp-growth

August 15, 2023

European Natural Gas Prices Surge

European NatGas Surges 15% As Strike Threats Mount At Australian LNG Plants

by Tyler Durden

Tuesday, Aug 15, 2023 – 10:10 AM

Yet another stunning move in European NatGas on Tuesday as prices soared 15% following last week’s 40% jump due to increasing labor action risks in Australia.

Bloomberg spoke with energy traders who said the Gorgon facility on Barrow Island off the northern coast of Western Australia had reduced sales over the increasing risks of a strike.

Talks were scheduled to take place between union officials and Woodside Energy Group Ltd., one of the two companies operating the affected liquefied natural gas facilities. –BBG

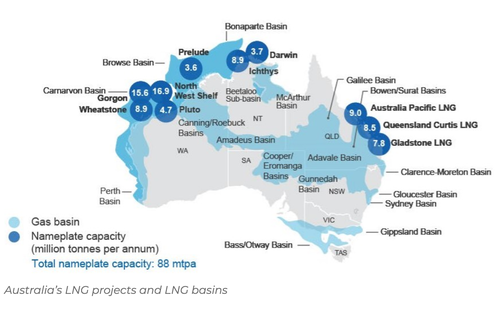

A Goldman Sachs analysis revealed potential strikes at three top LNG sites operated by Chevron and Woodside Energy Group Ltd. could disrupt global supplies. These three locations account for as much as 10% of global LNG exports.

“The potential for strike action at LNG export plants in Australia once again highlights the fact that we are now clearly in a globalised gas market,” ICIS analyst Tom Marzec-Manser told the Financial Times.

“Europe has understandably backfilled Russian pipeline supply with versatile LNG. But that versatility leads to increased price volatility.”

On Monday, Australia’s Fair Work Commission approved workers at Chevron’s Wheatstone offshore platform to vote on possible industrial action. This follows earlier labor action votes for workers at Wheatstone and Gorgon downstream facilities and at Woodside’s North West Shelf.

Australia’s Top Producing LNG Areas

Today’s news sent European benchmark NatGas futures up 15%. Prices soared 40% last week after the first report of potential labor action at various LNG facilities in Australia could threaten global supply.

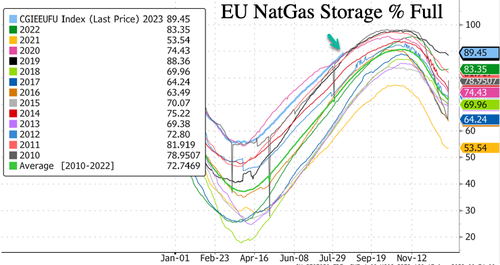

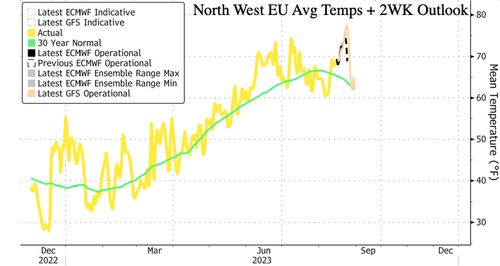

The good news for Europe is that demand for NatGas remains soft. Storage facilities across the continent are 89.45% full, the highest level for this time of year in over a decade.

Before Europe and much of the Northern Hemisphere realize it, the heating season will arrive in the next couple of months, driving demand for NatGas higher.

The bad news is that Europe’s decoupling of reliable and cheap NatGas flows from Russia subjects it to sourcing the fuel elsewhere around the globe, making it prone to supply snarls and or what could soon be labor actions in Australia.

“The crisis is not over yet,” the chief executive of E.ON, one of Germany’s biggest utilities, said earlier this month.

“We must continue to work on the issue of austerity. This is the best way to ensure affordability for customers and also to achieve competitiveness of our society and our economy.”

If the CEO of E.ON is talking about austerity—not exactly a popular idea among regular electricity consumers—then the situation must be serious. It suggests there is no great chance of abundant LNG supply and weak competition from Asia that would make the commodity cheaper. That leaves limiting demand as the only choice.

Winter is coming