Current Affairs

August 14, 2023

Cash is King

Cash reserves running out for many trucking firms, Werner says

Smaller firms could exit the market more frequently amid higher fuel prices and other costs as well as depressed volumes, according to industry players.

Published Aug. 14, 2023

David TaubeAssociate Editor

Dive Brief:

- Trucks will exit the market more quickly given depletions in cash, Werner Enterprises CEO Derek Leathers told investors on a Q2 earnings call, detailing the carrier’s ability to benefit from the reduced capacity.

- Executives with the carrier believe smaller trucking firms raked in cash amid 2022’s heyday, federal stimulus and lower fuel cost. But now that abundance of cash is now largely exhausted, Leathers said.

- Based on Werner’s internal analytics on how long the average carrier could stay afloat during the downturn, the TL provider thinks “those months are up,” spurring an “accelerated pace” of truck deactivations, Leathers said.

Dive Insight:

Federal data suggests that over 110,000 net deactivations have occurred for nearly a year, Werner reported.

Federal Motor Carrier Safety Administration data showed net truck deactivations for 44 consecutive weeks, Leathers said.

“Now they find themselves in an environment with rising interest rates and their finance costs are higher than ever,” said Leathers, who also serves as the carrier’s president and chairman.

Others are sharing similar observations.

Transportation tech services provider Motive, formerly KeepTruckin, reported that new carrier starts dropped below 10,000 in July, following a “trend of reverting to 2019 levels and marking a 29% decline since the beginning of the year,” according to a monthly economic report.

Many of those exiting fleets are now involving carriers with five or more vehicles, meaning the downturn is expanding beyond early stages when smaller firms were hit hardest, Motive reported.

Gene Graves of the United Shippers Alliance, an organization which negotiates rates with LTL providers and other transportation, projects hardships for carriers given Yellow’s demise and insurance increases.

“Every year there’s always a bunch of small LTL guys” exiting the market, said Graves, the alliance’s executive director. He added that the shakeout could be bigger than most years given the circumstances.

But amid the depressed volume, Graves foresees significant expansion from larger carriers.

“They’re gonna get bigger,” he said. “They have the capacity right now. They’re building new capacity.”

https://www.transportdive.com/news/fmcsa-net-deactivations-2023-trucks/690529/

August 7, 2023

Commercial Real Estate Blues

CRE Turmoil Worsens As Office Delinquencies Accelerate

by Tyler Durden

Monday, Aug 07, 2023 – 04:40 PM

Readers have been well informed about the deteriorating state of the commercial real estate sector, with reports from major banks showing a downturn amid high-interest rates and tightened credit, which has pushed up borrowing costs and forced a rise in defaults.

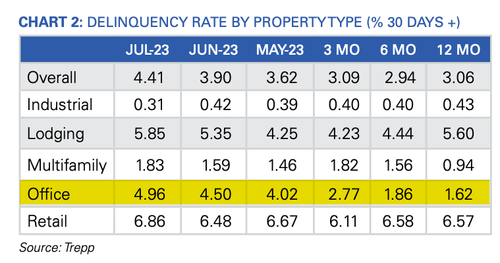

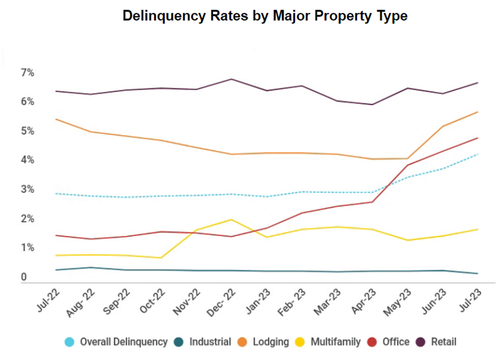

The latest data from Trepp, which tracks commercial mortgage-backed securities (CMBS) securities market data, shows the delinquency rate of commercial property loans packaged up by Wall Street jumped again in July, with four of the five major property segments posting increases.

“While the rest of the US economy has seen relief in terms of higher equity prices, better-than-expected corporate earnings, and falling inflation numbers, the commercial real estate (CRE) market continues to be left behind,” Trepp wrote in the report.

Trepp data found the delinquency rate rose 51 basis points to 4.41% last month — the highest level since December 2021. Office delinquencies increased by 46 basis points to 4.96% — up more than 350 basis points since the end of 2022. The deterioration in the office segment is intensifying at an alarmingly rapid pace.

A broad overview of the US CMBS market shows the delinquency rate increased to 4.41%, a 51bps rise compared to the previous month, but still significantly lower than the 10.34% rate recorded in July 2012. The rate peaked at 10.32% in June 2020 during the government-forced Covid lockdowns.

Here are more highlights from the report:

- Year over year, the overall US CMBS delinquency rate is up 135 basis points.

- Year to date, the rate is up 137 basis points.

- The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or non-performing balloons) is now 3.92%, up 20 basis points for the month.

- If defeased loans were taken out of the equation, the overall headline delinquency rate would be 4.64%, up 51 basis points from June.

- One year ago, the US CMBS delinquency rate was 3.06%.

- Six months ago, the US CMBS delinquency rate was 2.94%.

To better understand what might come next for the CRE market, Kiran Raichura, Capital Economics’ deputy chief property economist, recently warned in a note to clients that the office segment might experience a 35% plunge in values by the second half 2025 and “is unlikely to be recovered even by 2040.”

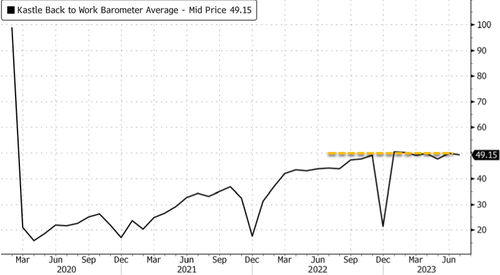

According to swipe data from Kastle Systems, the US office occupancy rate is less than 50%. The figure has plateaued since September, indicating a new reality of remote work.

One major hurdle for CRE space is that “more than 50% of the $2.9 trillion in commercial mortgages will need to be renegotiated in the next 24 months when new lending rates are likely to be up by 350 to 450 basis points,” Lisa Shalett, chief investment officer for Morgan Stanley Wealth Management, wrote in a note to clients.

Shalett expects a “peak-to-trough CRE price decline of as much as 40%, worse than in the Great Financial Crisis.”

Bank of America analysts expect challenges in the CRE space but noted, “They are manageable and do not represent a systemic risk to the US economy.”

Meanwhile, analysts at UBS warned:

“About $1.3 billion of office mortgage loans are currently slated to mature over the next three years.

“It’s possible that some of these loans will need to be restructured, but the scope of the issue pales in comparison to the more than $2 trillion of bank equity capital. Office exposure for banks represents less than 5% of total loans and just 1.9% on average for large banks.”

We’ve already seen major building owners returning their office towers and malls to lenders in California (here & here) and elsewhere (here). This will result in an uptick in CMBS delinquencies moving forward.

… and remember what we wrote during the regional bank crisis earlier this year — the note was titled “Nowhere To Hide In CMBS”: CRE Nuke Goes Off With Small Banks Accounting For 70% Of Commercial Real Estate Loans.

https://www.zerohedge.com/markets/cre-turmoil-worsens-office-delinquencies-accelerate

August 7, 2023

The Fine Print

Privacy Storm Brewing As Zoom’s Updated Terms Greenlight AI Model Training With User Data

by Tyler Durden

Monday, Aug 07, 2023 – 12:25 PM

Zoom has added a clause to its Terms-of-Service (TOS) which allows the video conferencing company to use customer-generated content for any purpose they see fit, including to train artificial intelligence (AI) models, with no opt-out.

Zoom’s TOS, last revised on July 26th, conceals a concerning caveat. Nestled within section 10.4, for those brave enough to venture, is language that confers upon Zoom a carte blanche right to exploit what it coins as “Service Generated Data” (SGD). This expansive designation encompasses a cornucopia of user-generated information – from innocuous telemetry data to incisive diagnostic insights – all grist for the AI mill.

Section 10.4 also describes the company’s use of Customer Content (defined as “data, content, files, documents, or other materials”), not just telemetry data and the like, which it can use “for the purpose of product and service development, marketing, analytics, quality assurance, machine learning, artificial intelligence, training, testing, improvement of the Services, Software, or Zoom’s other products, services, and software, or any combination thereof.”

The company makes clear that it will be using data for, among other things, fine-tuning AI models and algorithms. The potential consequences are manifold, raising red flags for privacy pundits and sparking debates over the boundaries of user consent.

Zoom’s data net is cast even wider with a perpetual, worldwide, non-exclusive, royalty-free, sublicensable, and transferable license. This legal carte blanche emboldens Zoom to undertake a multitude of actions that span the entire data lifecycle. From reconstituting, republishing, and accessing user content to the deep recesses of data modification, redistribution, and algorithmic processing, the breadth of Zoom’s dominion over user-generated data now defies conventional comprehension.

Zoom contends that these data maneuvers are vital to service provision, bolstering software quality, and enhancing the broader Zoom ecosystem. The augmentation of AI capabilities, epitomized by Zoom IQ, has been touted as a beacon of collaboration, promising efficient meeting summaries, task automation, and optimized follow-ups, all enabled by the seamless integration of user data.

“With the introduction of these new capabilities in Zoom IQ, an incredible generative AI assistant, teams can further enhance their productivity for everyday tasks, freeing up more time for creative work and expanding collaboration,” said Zoom chief product officer, Smita Hashim. “There is no one-size-fits-all approach to large language models, and with Zoom’s federated approach to AI, we are able to bring powerful capabilities to our customers and users through Zoom’s own models as well as our partners’ models.”

In 2021, Zoom agreed to settle a class-action privacy lawsuit for $86 million, after plaintiffs accused the company of violating the privacy of millions of users by sharing personal data with Facebook, LinkedIn and Google.

The controversial section of the TOS reads (emphasis ours):

Customer License Grant. You agree to grant and hereby grant Zoom a perpetual, worldwide, non-exclusive, royalty-free, sublicensable, and transferable license and all other rights required or necessary to redistribute, publish, import, access, use, store, transmit, review, disclose, preserve, extract, modify, reproduce, share, use, display, copy, distribute, translate, transcribe, create derivative works, and process Customer Content and to perform all acts with respect to the Customer Content: (i) as may be necessary for Zoom to provide the Services to you, including to support the Services; (ii) for the purpose of product and service development, marketing, analytics, quality assurance, machine learning, artificial intelligence, training, testing, improvement of the Services, Software, or Zoom’s other products, services, and software, or any combination thereof; and (iii) for any other purpose relating to any use or other act permitted in accordance with Section 10.3. If you have any Proprietary Rights in or to Service Generated Data or Aggregated Anonymous Data, you hereby grant Zoom a perpetual, irrevocable, worldwide, non-exclusive, royalty-free, sublicensable, and transferable license and all other rights required or necessary to enable Zoom to exercise its rights pertaining to Service Generated Data and Aggregated Anonymous Data, as the case

August 6, 2023

LTL Price Hikes Ahead

Yellow shutdown likely means LTL price increases, analysts say

The low-cost carrier’s rivals see an opportunity to bring in loads at higher rates as bankruptcy looms.

Published Aug. 4, 2023

David TaubeAssociate Editor

Yellow Corp.’s shutdown has left shippers without a major player in the less-than-truckload space — a development that means higher costs are likely in store, according to trucking industry analysts.

“There’s probably going to be an increase in the pricing charged to the shipper,” said Craig Decker, who leads investment banking activities across supply chain, logistics and transportation areas at Brown Gibbons Lang & Co.

The price difference could be a 20% to 25% price per pound increase depending on the circumstances, DAT Chief of Analytics Ken Adamo suggested on a weekly market update show. All together, he said the price increases could be 7% to 10% higher.

“[If] you decided late last week to send ArcBest, Old Dominion, XPO and FedEx Freight your data to get some rates back, probably by late this week you’re going to be fully processing the sticker shock of how much of a price increase you’re going to have to take over what Yellow was charging you,” Adamo said.

XPO executives noted Friday on a Q2 earnings call that Yellow’s shuttering is disrupting the market and accelerating their pricing. ““Our customers understand: When you take 10% of capacity out of the market, it’s going to cost more to move freight,” incoming CFO Kyle Wismans said.

The increase to rates comes as a result of Yellow’s role in the trucking market: Shippers who relied on the low-cost carrier are likely left with higher-priced alternatives, analysts said.

“As one of the US’ most cost-effective LTL transport companies, businesses switching from Yellow to a more expensive rival carrier will experience a twofold cost increase,” Charles Haverfield, CEO of U.S. Packaging & Wrapping, said in emailed comments.

Haverfield said this is particularly true if shippers have not built relationships with other carriers to secure discounted prices or if they switch to smaller trucking companies that cannot leverage Yellow’s economies of scale to lower prices for their services.

“The best approach is for businesses to adopt a comprehensive approach, encompassing both major carriers and smaller freight companies,” Haverfield said.

Shippers had been diverting freight to other carriers, brokers and the spot market even before Yellow confirmed it was shutting down terminal operations and laying off workers.

August 3, 2023

Oil Update

Oil Rebounds After Reports That Saudis Will “Extend, Deepen” Voluntary Production Cuts

by Tyler Durden

Thursday, Aug 03, 2023 – 09:00 AM

Update (0900ET): Well, we appear to have our answer to the most anticipated question for oil traders.

We noted earlier (below): “We see no looming change in the group’s current supply cadence, nor the required production adjustments set to take effect in 2024,” says Helima Croft at RBC Capital Markets, in a note.

“The question that market participants remain focused on is whether Saudi Arabia will sunset its unilateral 1 mb/d cut at summer’s end or roll it over for another month.”

The Saudi Press Agency is reporting:

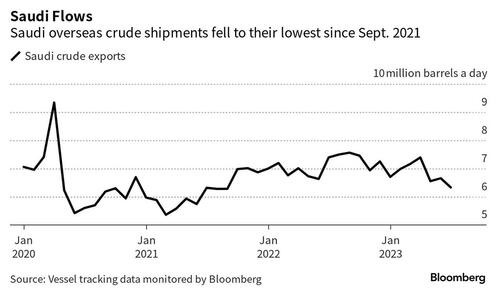

An official source from the Ministry of Energy announced that the Kingdom of Saudi Arabia will extend the voluntary cut of one million barrels per day, which has gone into implementation in July, for another month to include the month of September that can be extended or extended and deepened.

In effect, the Kingdom’s production for the month of September 2023 will be approximately 9 million barrels per day.

The source also noted that this cut is in addition to the voluntary cut previously announced by the Kingdom in April 2023, which extends until the end of December 2024.

The source confirmed that this additional voluntary cut comes to reinforce the precautionary efforts made by OPEC Plus countries with the aim of supporting the stability and balance of oil markets.

This has prompted gain in WTI, erasing much of yesterday’s DOE-driven dump…

* * *

As Bloomberg’s Grant Smith detailed earlier, the biggest question in oil markets is how long Saudi Arabia will extend its 1 million-barrel-a-day supply cut. Riyadh’s handling of a previous strategy offers some guidance — and reassurance — for crude bulls.

The kingdom launched the unilateral cutback last month in a bid to shore up global oil markets, undertaking the solo effort as its comrades in the OPEC+ coalition had already cut output as much as they could bear. It’s had some qualified success, boosting Brent prices to a three-month high above $85 a barrel in London.

The Saudis have committed to extending the measure into August, and OPEC-watchers expect that Riyadh will announce a further continuation into September this week. Traders are bracing for a statement from Saudi state media in the next couple of days, before an OPEC+ monitoring committee convenes to assess markets on Friday.

To understand what the world’s biggest crude exporter may do after that, it’s useful to consider how it handled a similar intervention two years ago.

In January 2021, the Saudis announced a unilateral 1 million-barrel cut to amplify the efforts of its OPEC+ brethren, to take effect in February and March. It was subsequently extended for one more month, and then unwound in stages over the following three months.

One lesson to draw is that the kingdom is prepared to go it alone with supply curbs for a considerable period; it’s quite possible that the restraints adopted in early 2021 could have lasted longer if others in OPEC+ hadn’t been so eager to increase production.

But at the same time, the limited three-month span of the move shows the Saudis won’t make such sacrifices indefinitely. Energy Minister Prince Abdulaziz bin Salman has described this summer’s curbs as a “lollipop” for markets — and at some point all treats must be taken away.

Perhaps the most important final lesson is that, when it comes to restoring shuttered supplies, Riyadh prefers a cautious and gradual approach rather than any sudden moves.

As a result, we may see the latest 1 million-barrel reduction eventually unwound in piece-meal stages. And that ought to give confidence to oil bulls betting that the current rally can go further.

https://www.zerohedge.com/markets/oil-bulls-edge-ahead-saudi-production-cut-extension