The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

January 13, 2023

PRESS RELEASE: January 10, 2023 (Fresno, California)

General Coatings Manufacturing Corporation

Laxmi “Lax” Gupta built one of the largest family-owned systems houses in the United States under

his leadership over his 50-year career in the polyurethanes industry. He ran a family and customer

centric business enterprise and focused on innovation through Research and Development leading

to high performance products produced under the strictest quality control procedures. He left an

enduring legacy which will be continued by his wife Urmila Gupta and his three children, Dr. Shalesh

Gupta, Dr. Anjula Gupta and Dr. Sandeep Gupta, who are actively involved in managing all of his

businesses. Many other family members and now the third generation, Lax’s grandchildren, have

started to enter the businesses as well.

The owners of General Coatings Manufacturing Corporation (GCMC) would like to announce

appointment of Will Lorenz as the new President of General Coatings Manufacturing Corporation.

Will Lorenz has been Vice President of – National Sales in Spray Foam Roofing & Tank Systems for

GCMC. He received a BA in Chemistry from the College of Wooster, Ohio and an MBA from the

University California Irvine in 1996.

Prior to joining GCMC, Lorenz worked at Amoco Chemicals, Mobay

Corporation, ICI Polyurethanes, Henry Company, and Arnco. He is part of

multiple industry organizations. He is President of RCMA, a board member

of SPFA, on the Spray Foam Contractors (SFC) Leadership Committee, on

the Spray Foam Manufacturer Government Affairs Committee, and a

member of NRCA, National Roof Contractors Association.

“I see my role is to bring the GCMC team together and unleash our

capabilities. We pursue our goals through embracing Lax’s keen

entrepreneurial spirit, bringing new energy saving roofing solutions, and

unparalleled personal commitment to our dedicated contractors.” –

Lorenz

January 13, 2023

2022 big events of spandex industry

Text size

| Macro environment was complex and changeable in 2022. Global economy decreased due to the raise of interest rate in US, energy price soared amid the Russia-Ukraine conflict and market liquidity weakened because of the repeat spread of COVID-19 pandemic in local China. Global economy faced high inflation and low growth rate, in stagnation stage. Spandex market was greatly affected by the macro environment in 2022. Demand for spandex was apparently insufficient. The weakness was transferred to upstream market from the downstream sector. Spandex market saw obviously worse price, operating rate, inventory and profit in 2022.Macro policies 1. Implementation of tax rate on spandex value chain in RCEP AgreementThe Regional Comprehensive Economic Partnership Agreement (RCEP) entered into force on January 1, 2022, mainly involving six ASEAN members, including Brunei, Cambodia, Laos, Singapore, Thailand and Vietnam, and four non-ASEAN members, including China, Japan, New Zealand and Australia.With the help of RCEP reciprocal tariffs, the growth rate of textile exports to Europe and the United States was greater than that to Europe and the United States. From January to October 2022, ASEAN accounted for 16.97% of China’s textile and apparel exports, surpassing the United States to become China’s largest export market, with an increase of 20.9 percent over the same period of last year; the United States took up 16.85%, with a decrease of 1.58 percent on annual basis; and the European Union accounted for 14.7%, with an increase of 4.73 percent year on year. 2023 is the second year of the entry into force of the RCEP, and trade terms and tariff dividends on exports to ASEAN will be further released. 2. Ministry of Industry and Information Technology and National Development and Reform Commission issued relevant guidance on chemical fiber and textileThe Ministry of Industry and Information Technology and the National Development and Reform Commission issued the guidance on the High-quality Development of the Chemical Fiber Industry on April 21, 2022 proposing that by 2025, the industrial added value of chemical fiber enterprises above scale will grow at an average annual rate of 5%. The proportion of chemical fiber output in the world will be basically stable. Upstream feedstock market 1. Capacity expansion 1) Shaanxi Shanhua’s BDO second phase alkynation efficiency improvement project starts operation successfully The second phase of the alkynation efficiency improvement project from Shaanxi Shanhua was successfully started up at one time in November, 2022, completed the activation of the catalyst, and produced qualified 1,4 butynediol. The second phase of BDO alkynation efficiency improvement project is a key project for Shaanxi Shanhua to improve both BDO production capacity and efficiency. 2)Inner Mongolia Dongjing commenced 280KTA BDO plant On November 24, 2022, after more than a year of intensive construction, Inner Mongolia Dongjing Biological Environmental Protection Technology Co., Ltd., located in Wuda Industrial Park of Wuhai, has successfully started up its 1,4-butanediol (BDO) plant with an annual output of 280000 ton. After a day of debugging, the purity has reached 99.91%, which indicated that Dongyuan Technology has become the world’s largest integrated production base of BDO with an annual BDO capacity at 380kt. 3) Wanhua Chemical’s MDI unit started production successfully in Fujian Wanhua Chemical Group Holding Company Wanhua Chemical (Fujian) Isocyanate Co., Ltd.’s 400kt/year MDI unit has successfully started operation on Dec 22, 2022, with qualified products available. This project will further optimize company’s MDI industrial layout and improve global industrial competitiveness. 2. New National Standard (2022 Version) for the PTMEG implemented The 2022 version of PTMEG new national standard, led by Sichuan Tianhua Fubon Chemical Co., Ltd., and jointly drafted by Chongqing Jianfeng New Materials Co., Ltd. Chiyuan Chemical Branch, Shaanxi Shanhua Coal Chemical Group Co., Ltd., CPP (Panjin) Co., Ltd., Dairen Chemical (Jiangsu) Co., Ltd., Xinjiang Blue Ridge Tunhe Energy Co., Ltd., Zhonglan Chengguang Chengdu testing Technology Co., Ltd. and CGN Juner (Zhejiang) New Materials Co., Ltd. has been issued and implemented from November, 2022.Spandex sector 1. Spandex capacity exceeded 1 million tons for the first time By the end of 2022, the capacity of spandex exceeded 1 million tons to be 1.0965 million tons/year in Chinese mainland, up by 12.9% or 125kt/year on the year. Three companies had new capacity in the first half of 2022, namely Hyosung Ningxia, Huafon Chongqing and Xinxiang Chemical Fiber, with total new capacity at 90kt/year. Four companies had new capacity in the second half of year, namely Tayho Ningxia, Zhuji Huahai, Xinxiang Chemical Fiber and Zhuji Qingrong, with total new capacity at 60kt/year. 25kt/year of capacity was eliminated at the end of 2022. The total increment of capacity was at 35kt/year combined with the new expansion and eliminated capacity in the second half of 2022.Spandex market saw extreme operation in 2022. New capacity expansion was big. However, some export orders flew to Southeast Asia and South Asia in the second and third quarter. Domestic and export demand was soft in the fourth quarter impacted by the spread of pandemic and the high inflation outside China. Demand for spandex saw a rare negative growth. The operating rate of spandex plants averaged at 76.4% in 2022, down by 18.2 percentage points on the year, with the highest and lowest level at 94% in mid-Mar and 55% in mid-Aug. 2. Huafon Group completed the M&A of bio-based business under DuPont On June 1, 2022, Beijing time, Huafon Group formally completed the delivery of the related business and technology of bio-based products spun off by DuPont of the United States. This is by far the largest overseas M&A transaction of Huafon Group. 3. Bangtai’s bio-based melt-spun spandex successfully passed the USDA Bio-based Product Certification On Jun 1, in order to realize the recycling of resources and build a sustainable future, Bangtai has a foothold in the field of new materials and plays a green role under the strategic goal of “Dual Carbon”. Bangtai’s technical team has successfully developed bio-based melt spinning spandex products and successfully passed the U.S. Department of Agriculture (USDA) Bio-based Product Certification! 4. Hyosung’s biological spandex certified by SGS On Jul 26, Hyosung is the world’s largest spandex manufacturer and the first global developer to commercialize biological spandex. Hyosung creora® bio-spandex has been certified by Standard Global Services (SGS) as an eco-product, ensuring that the product is made of plant materials and produced in a harmless and environmentally friendly environment. SGS is a leading inspection, accreditation, testing and certification organization and a globally recognized benchmark for quality and integrity. 5. The spread of pandemic affected the operation of some textile and apparel markets The COVID-19 pandemic had an obvious impact on the business of textiles and apparels in 2022. Some professional textile and apparel markets in Shanghai, Guangzhou, Hangzhou, Shenyang, Haicheng, Shaoxing, Xinjiang, Zhuzhou and Nantong were closed for a long time. 6. Textile companies went abroad to snatch orders At the end of the 2022, after China’s epidemic prevention and control measures were optimized, textile enterprises either set out on their own or joined the “order-grabbing regiment” organized by the government to get new orders and talk about new investment abroad so as to quickly expand market. |

http://www.ccfgroup.com/newscenter/newsview.php?Class_ID=D00000&Info_ID=2023011330026

January 13, 2023

Europur: Supply situation improves / prices of raw materials historically high

Jan 10, 2023

According to Europur, the European Association of Flexible PU Foam Blocks Manufacturers, even though gas prices in Europe have receded compared to the summer, they remain historically high and volatile in Europe, creating difficulties for the entire chemicals industry, in which gas is used both as a raw material and as a source of energy.

As reported by CEFIC, the European Chemical Industry Council, in October 2022 for the first time ever Europe imported more chemicals than it exported, and the industry at large is at “a breaking point”. Major German raw materials suppliers, also active in the polyurethane supply chain, have warned that the situation may prompt them to adapt their European strategies in the short term.

Being strongly dependent on the supply of chemical raw materials, the above means the situation was precarious over the autumn for the flexible polyurethane foam industry. Especially since this was combined with the additional difficulty that the three European sites producing TDI (Toluene Diisocyanate) – one of the main chemicals used to make foam blocks – halted production for various reasons. While two have in the meantime restarted production, one of them remains under force majeure. All suppliers did their utmost to stabilize supply, notably by using their global networks to import TDI from Asia and the USA, but such extensive rotations of ships require time to be put in place.

In parallel, demand for foam is reported to have decreased due to reduced demand, mostly from the upholstered furniture and bedding markets, as Europeans divert their spending to other items.

As a result of the declining demand and of the restart of European production / stable imports of chemicals, foam shortages have largely receded during November 2022. Prices of chemical raw materials have also started to stabilise. However, with continued high gas prices, they remain historically high as reported in specialised trade press.

The evolution of the situation for the future remains quite uncertain, as the flexible polyurethane foam supply chain can be influenced positively or negatively by any of these factors:

- Gas prices in Europe and operational cost of the chemical industry / anticipated uncertainty on stability of gas supply in Europe over much of 2023.

- The evolution of the pandemic in Asia and particularly China, which can influence price of chemical raw materials at global level and possibility for exports to Europe.

- Evolution of demand in Europe for foam-containing products, especially mattresses and furniture.

January 12, 2023

PRESS RELEASE: January 9, 2023 (Santa Fe Springs, California)

American Polymers Corp.

Polycoat Products (a Division of American Polymers)

Chemco Systems, Inc (a wholly owned company of American Polymers)

SuperSkinSystems (a Division of American Polymers)

Laxmi “Lax” Gupta built one of the largest family-owned systems houses in the United States under

his leadership over his 50-year career in the polyurethanes industry. He ran a family and customer

centric business enterprise and focused on innovation through Research and Development leading

to high performance products produced under the strictest quality control procedures. He left an

enduring legacy which will be continued by his wife Urmila Gupta and his three children, Dr. Shalesh

Gupta, Dr. Anjula Gupta and Dr. Sandeep Gupta, who are actively involved in managing all his

businesses. Many other family members and now the third generation, Lax’s grandchildren, have

started to enter the businesses as well.

The owners of American Polymers Corp. would like to announce appointments of Ashish

Dhuldhoya as the new President of Polycoat Products and of Dev Kumar and Dr. Mahesh Kotnis, as

Executive Vice Presidents of American Polymers Corp.

Executive Leadership Team consisting of the owners, Ashish Dhuldhoya, Dev Kumar, and Dr. Mahesh

Kotnis will oversee the management of all group companies, including American Polymers, under

the current ownership.

Ashish Dhuldhoya has proven to be an innovative and effective leader for the

past 35 years. Coming from India with a B.S. in Chemical Engineering from LD

College of Engineering, Ashish started as a plant operator at Polycoat in 1987.

In 1999, when Polycoat faced a pivotal moment, Ashish stepped in and

engineered a plan that put the company back on a growth path and has

continued to grow the company ever since. His strategic thinking and strong

leadership have made him an invaluable asset to American Polymers.

Dev Kumar holds a master’s degree in Industrial and Production Engineering

from Indian Institute of Technology, Roorkee. Prior to joining Polycoat

Products in 1998, Dev held various leadership roles in Engineers India Ltd

(formerly Bechtel India) for 28 years and was responsible for many large

complex projects involving grass root refineries, gas processing, fertilizer, and

naphtha cracker plants. At Polycoat, Dev was responsible for modernization

and expansion of Santa Fe Springs facility and then for strategic planning and

M&A.

Prior to joining American Polymers as Executive Vice President, Dr. Kotnis

worked in various senior leadership roles in multinational companies such as

Huntsman, Ciba Specialty Chemicals, and ICI Americas over the last 30 years. He

has a proven track record of building profitable businesses and high-performing

teams which have delivered consistent above-market growth in diverse

economic conditions. Dr. Kotnis holds a Ph.D. from the University of

Massachusetts at Amherst in Polymer Science & Engineering.

The ownership of American Polymers is committed to making investments in human and plant

assets to keep the aggressive growth trajectory of American Polymers through organic and inorganic

growth. We recently completed acquisitions and successful integrations of two new companies

namely, SuperSkinSystems and ChemCo Systems. We are proud to share that our team has

completed projects to set up new plants for manufacturing of aromatic and aliphatic polyesters in

Arlington, Texas. In addition, plans and implementation of a low-free TDI plant are underway, with

planned completion sometime in 2024.

January 12, 2023

The Great Unwind: Busiest US Container Ports Went From Swamped To Eerily Quiet

by Tyler Durden

Thursday, Jan 12, 2023 – 10:59 AM

Container volumes at the twin ports of Los Angeles and Long Beach, California, are seeing steep declines versus one year ago, signaling a downturn in imported goods might suggest continued sinking economic activity.

The twin ports are the busiest container port complex in the country, responsible for 40% of all containerized flow, and are a major artery feeding overseas goods into the Heartland through rail and trucking networks.

Gene Seroka, the executive director of the Port of Los Angeles, told Bloomberg the days of more than 100 container ships waiting in queue and massive container backlogs are all but over.

Imports are sliding as major US retailers such as Walmart, Target, and Costco pull back on orders because of high inventories. Management of these retailers noted on recent earnings calls that consumer demand for big-ticket items such as electronics and furniture has waned because of elevated inflation and interest rates, leaving them with an abundance of supply in warehouses.

US retail sales tumbled in November, the Commerce Department said last month, as consumers buy staple items to survive the inflation storm rather than buying televisions and computers.

Last month, Seroka said, “We are seeing a nationwide slowing of imports.”

The latest charts show West Coast transport networks are slowing.

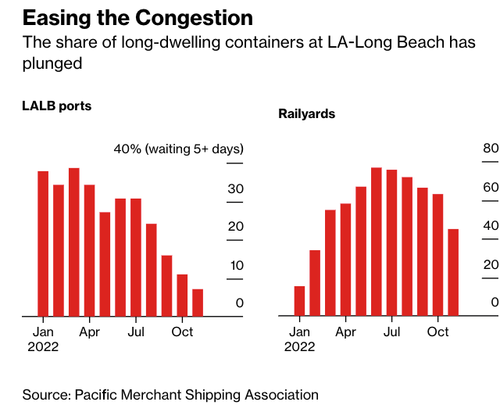

The first chart shows easing congestion at the largest containerized ports and slumping congestion on rail networks.

Seroka noted in the Bloomberg interview that easing backlogs meant processing containers through the twin ports has increased in speed.

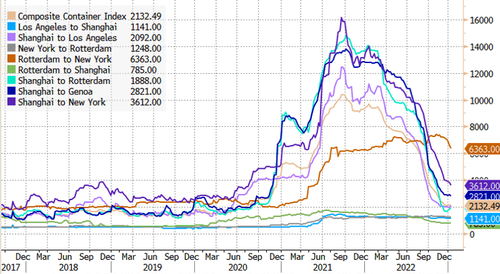

Next are container rates for major shipping lines that have plunged — some are nearing pre-pandemic levels.

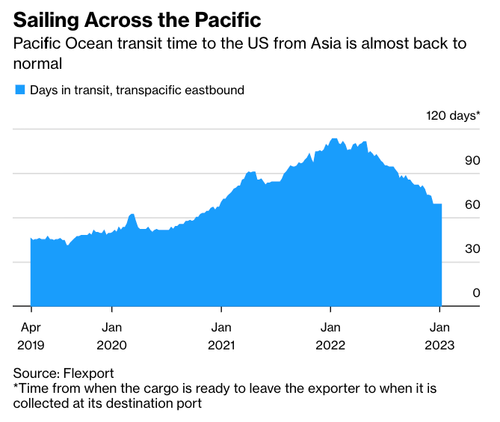

Transit times for vessels from Asia to the US are normalizing.

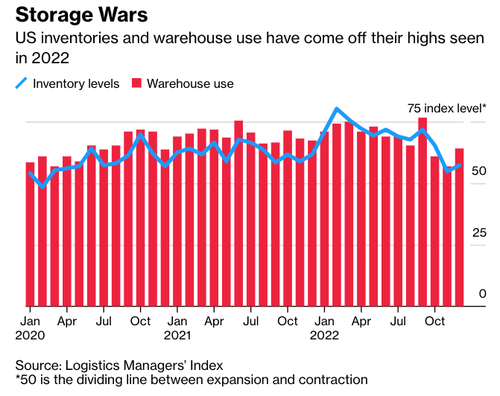

Inventory levels at warehouses are coming off a peak.

Separately, in a note on Wednesday, Goldman Sachs’ Patrick Creuset told clients, “demand destruction allowed for an unwinding of supply chain bottlenecks” across the air and sea networks. He expects this “will come to an end during 1Q23, with volumes returning to modest growth through the rest of the year.”

Creuset pointed out, “a record order book of containerships about to be delivered from 1Q23 through 2H24, and belly capacity set to gradually return in air cargo.” The good news is that seaborne transport capacity is about to be expanded.

And according to Morgan Stanley’s Ravi Shank, he expects retailers’ 12-15 month de-stocking cycle could reach a bottom and begin to normalize by the midpoint of the year, and it could even lead to an upcycle in the second half.

So the good news is the shipping downturn has cleared out supply chain snarls at some of the largest US containerized ports. It seems like retailers are at an inflection point, and once de-stocking is complete, they will increase overseas orders, which might not occur until the second half.

We ask why retailers would want to increase goods on hand if the IMF and World Bank are slashing global growth estimates and warning about recession.

https://www.zerohedge.com/markets/great-unwind-busiest-us-container-ports-went-swamped-eerily-quiet